The Rise of A.I. + 3 Stocks to Buy Today

In my years as a financial analyst, I’ve witnessed the rise and fall of many technological trends. But nothing has captivated my attention and imagination quite like Artificial Intelligence (AI). It’s not just a buzzword; it’s a monumental shift that’s reshaping industries, economies, and our very way of life. Every time I use Siri on my iPhone or read about the latest advancements in autonomous vehicles, I’m reminded of AI’s pervasive influence.

I’ve crafted this report especially for you, drawing from my extensive research and insights. I genuinely believe that understanding AI’s trajectory is not just beneficial—it’s crucial for anyone looking to navigate the future economic landscape of the United States. And here’s the exciting part: after pouring over mountains of data and analyzing market trends, I’ll be revealing three publicly traded stocks in the AI space that have caught my eye. These aren’t just random picks; they’re the culmination of my relentless pursuit to identify the next big thing in AI.

So, whether you’re an investor, a professional, or someone curious about the future, this report is for you. Let’s embark on this journey together and explore the transformative power of AI and its potential economic and financial implications for the American economy.

1. The Rise of AI: A Personal Overview

To me, AI represents the pinnacle of human innovation. At its essence, AI is about machines mimicking human intelligence processes—learning, reasoning, and self-correcting. Over the past decade, I’ve closely followed the advancements in machine learning, deep learning, and neural networks, watching AI evolve from theoretical discussions to real-world applications.

Key Milestones in AI Development:

- 1950s: Alan Turing’s groundbreaking Turing Test proposal.

- 1980s: The intriguing emergence of expert systems.

- 2000s: The game-changing rise of machine learning and neural networks.

- 2010s: The awe-inspiring breakthroughs in deep learning and AI’s commercialization.

2. AI’s Economic Impact on the American Economy

a. Job Creation and Displacement

While there are concerns about AI leading to job losses, it’s essential to understand that AI will also create new job categories. For instance, while routine tasks may be automated, roles in AI development, maintenance, and oversight will emerge.

b. Boosting Productivity

AI can analyze vast amounts of data faster and more accurately than humans. This capability can lead to increased efficiencies, reduced errors, and enhanced productivity across sectors, from healthcare to finance.

c. New Business Models and Opportunities

AI opens the door to innovative business models. For example, personalized marketing strategies powered by AI can offer tailored experiences to consumers, leading to increased customer loyalty and revenue.

d. Impact on GDP

According to a study by Accenture, AI has the potential to boost the U.S. economy’s annual growth rate from 2.6% to 4.6% by 2035, translating to an additional $8.3 trillion in gross value added.

3. Financial Implications of AI

a. Banking and Finance

AI-driven algorithms can detect fraudulent activities in real-time, offer personalized financial advice, and automate routine tasks, leading to cost savings and enhanced customer experiences.

b. Investment Strategies

Robo-advisors, powered by AI, are democratizing the investment landscape, offering personalized investment strategies to the masses.

c. Insurance

AI can streamline claims processing, assess risks more accurately, and offer personalized insurance products.

4. AI’s Impact on Everyday Americans

a. Healthcare

AI-powered diagnostic tools can detect diseases earlier and more accurately, leading to better patient outcomes and reduced healthcare costs.

b. Education

Personalized learning experiences powered by AI can cater to individual student needs, leading to improved learning outcomes.

c. Transportation

Autonomous vehicles can lead to safer roads, reduced traffic congestion, and a potential decline in transportation costs.

5. Three Stocks to Watch in the AI Space

1. NVIDIA (NVDA)

- Overview: A leading player in the GPU market, NVIDIA’s chips are crucial for AI computations.

- Recent Performance: In the past year, NVDA has seen a 50% increase in stock price.

- Future Outlook: With the growing demand for AI capabilities, NVIDIA’s role in AI hardware makes it a stock to watch.

2. Alphabet Inc. (GOOGL)

- Overview: Google’s parent company, Alphabet, is heavily invested in AI, from search algorithms to autonomous vehicles.

- Recent Performance: GOOGL’s stock has risen by 40% in the past year.

- Future Outlook: With diverse AI applications, from healthcare to automotive, Alphabet’s AI ventures position it for significant growth.

3. OpenAI

- Overview: A leading research organization turned company, OpenAI is at the forefront of AI innovations.

- Recent Performance: As a private company, exact figures are undisclosed, but industry insiders see OpenAI as a significant player in the AI space.

- Future Outlook: With its commitment to ethical AI and groundbreaking research, OpenAI is a company to watch as the AI industry evolves.

Conclusion

Artificial Intelligence is not just a technological advancement; it’s a paradigm shift. Its economic and financial implications for the American economy are vast, from job creation to GDP growth. As AI continues to permeate every facet of our lives, it offers both challenges and opportunities. For the discerning investor, the AI space presents a realm of possibilities, with companies like NVIDIA, Alphabet, and OpenAI leading the charge. The future is AI-driven, and for everyday Americans, this future holds promise, potential, and unprecedented change.

Where to invest $500 Right Now?

Before you consider buying any of the stocks in our reports, you’ll want to see this.

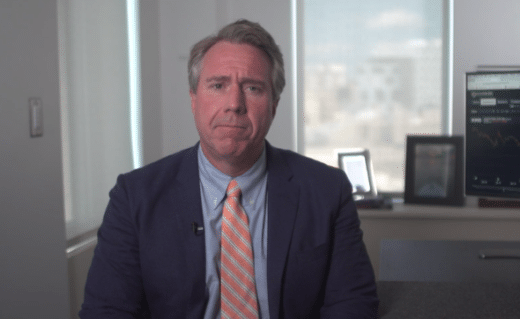

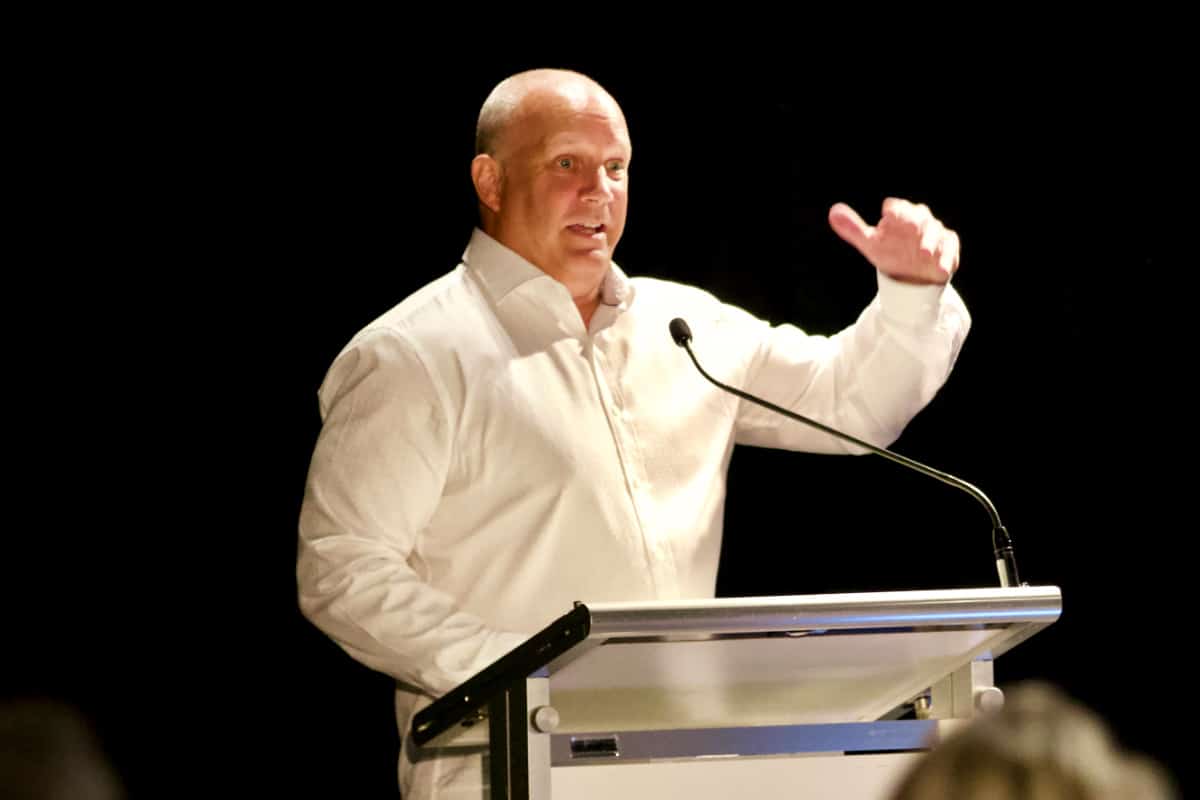

Investing legend, Marc Chaikin just revealed his #1 stock for 2024…

And it’s not in any of our reports.

During his career of nearly 50 years, Marc Chaikin was one of the quantitative minds behind some of the most famous investors in history: Paul Tudor Jones, George Soros, Steve Cohen, and Michael Steinhardt.

Even the Nasdaq hired him to create three new indices.

And now he’s going live with his #1 pick for 2024.

You can learn all about it on Mr. Chaikin’s Website, here.

Wondering what stock he’s investing in?

Click here to watch his presentation, and learn for yourself…

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream… And by then, it could be too late.

Click here to reveal the name and ticker of Marc Chaikin’s no. 1 pick for 2024…