Investing for Passive Income: 5 Steps for Living Off Dividends Forever

How do you know that you are earning enough income to ensure that you can retire? I’m not even considering how to retire early. How do you know that you have enough income to just flat out retire? I’ll highlight one way that allows for you to capture both your retirement AND your income goals. Living off dividends is more realistic than you think.

Dividends are purely passive income. There is no debate about it in my opinion. You reap the benefits of dividend income after putting in some upfront time to make your investment decision. In addition, you are a minority owner in a business and maintain no controlling-interest decision making. Nor do you have to spend much time managing your investment. Just a few efficient reading every few months.

Thereafter, you can carve out a small amount of time to monitor your investments. With the rise of different mobile apps and speed of information, dividend investing is made for the modern investor for now and into the future.

Is living off dividends possible?

Historically, dividend investing has been viewed as a way for risk-averse, “belt and suspenders” investors to invest in the stock market. I couldn’t disagree with that mentality more. Dividend investing is one (if not my most) of my favorite ways to increase my income through passive income while also covering off my retirement goals.

Living off of dividends is a marathon. Not a sprint. However, do not take this marathon lightly. You should have the urgency to both increase your income and save for retirement by getting started immediately. The urgency for investing for passive income leads me to one of my favorite sayings:

“The best time to plant a tree was 20 years ago. The second-best time is today.”

Plant your dividend seed now by investing in dividend growth stocks. What will it take? Well, with an average dividend yield (I’ll explain later) of ~3.0% in your portfolio, you’d need approximately a $3.33 million portfolio to earn $100,000 per year in dividend income.

Is it feasible to live off of dividends right away? No. Can it happen over time? Of course. With a prudent plan and strategy, you can achieve the holy grail of passive income…. living off of dividends… sooner than you think. I’ll walk through some steps to help you invest for passive income.

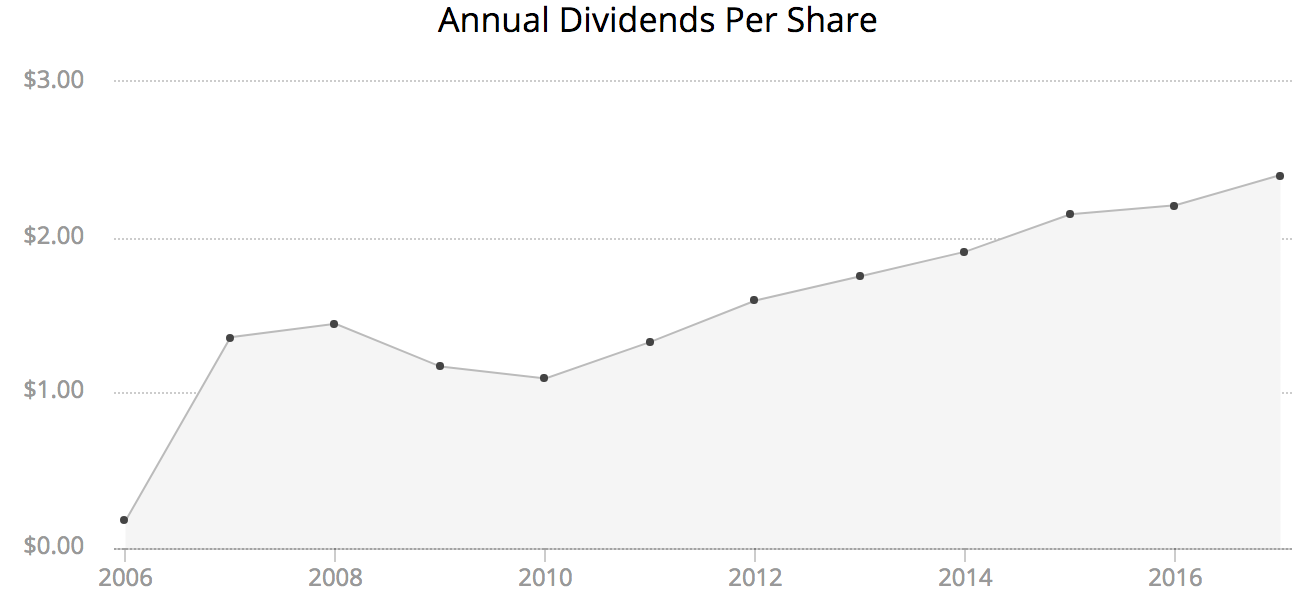

The key to living off of dividends is to focus on dividend growth stocks. Dividend growth stocks increase their dividends annually, which increases our income without doing a single thing.

Remember that saying about planting a seed? Well, it fits perfectly. If you invest the right way your seed will grow into a large redwood tree.

How to build a dividend portfolio for regular income

How do I get started with building a dividend portfolio? I’ve built a great infographic that shows how you should think about building a dividend portfolio. When building a dividend portfolio start scaling in small positions that you will continue to build over time.

First, I suggest you use a brokerage that offers the lowest commissions fee trading available. I currently use Robinhood, which allows me to trade completely commission-free on ALL stocks and options. This is huge because options are usually VERY expensive to trade.

When used properly, options are a great way to mitigate risk in your portfolio, put on a hedge in the case of downside scenario and boost your monthly income from your dividend portfolio. These are the best stocks for covered call writing.

Alternatively, you can use options to increase your income by writing put options. If the stock crosses below the exercise price, you can just buy the stock. This is a great tool to be able to participate in a stock if you don’t know if it will increase in the short-term. Here is a guide to selling weekly puts for income.

If you sign up, we BOTH receive a free share of stock! You can check out our Robinhood dividends guide and review to understand how the app works.

Having your commissions be as low as possible is key to ensure that you are not eroding your returns unnecessarily by paying sunk costs to the brokerages. We want to maximize earning potential for every single penny.

Robinhood has opened the flood gates for investing for passive income. The app has all the necessary news for your stocks right there and it is simple enough to discourage you from trading.

I don’t know about you, but I’m sick of the brokerages pushing retail investors to become traders overnight. With algorithmic trading, the retail investor has no place day trading. The Robinhood app was built for the passive income investor. Here are several other top investing apps to consider.

Dividend portfolio allocation

I suggest the following allocation of exposure to different types of dividend stocks to ensure a successful dividend growth portfolio:

- 20% of your dividend portfolio should be allocated to Dividend Kings

- 35% of your dividend growth portfolio should be allocated to Dividend Aristocrats

- 30% of your dividend portfolio should be allocated to up and coming dividend stocks. We want stocks that have demonstrated a track record of increasing their dividend and rewarding shareholders. These stocks are not considered the ‘classic’ dividend growth stocks like the Dividend Kings or Dividend Aristocrats.

- The remaining 15% of your asset allocation in your dividend growth portfolio should be international dividend growth stocks. You can get a basket of international dividend growth stocks by investing in a global dividend growth fund. Or, you can select individual blue chip international dividend growth stocks.

Keep in mind Dividend Aristocrats have a strong track record of success. Dividend Kings are likely slower growers but have an even better track record of success.

At the end of the day, you should have a robust list of 25-30 dividend stocks to invest in over the long-term.

Once you have your invested dividend portfolio, you take any dividend income received and reinvest into your portfolio of dividend stocks. If you want to live off of dividends in the future, you need to invest the most you can today.

This is equivalent to the savings snowball, but with dividends. Dividend growth investing is a phenomenal way to capitalize on the power of compound interest due to the income potential and the ease of reinvestment into your portfolio.

I keep track of my dividend income and dividend stock prices via Personal Capital. I check this daily and it is completely free.

It’s so satisfying waking up after a weekend of relaxing and seeing $30+ of dividend income hit my dividend portfolio account. I love dividends. Time to go buy more stocks.

Important dividend investing calculations to consider

In general, dividend investing is not very complex. In fact, the simpler you keep it the better you’ll do. Good investing is boring. However, there are several dividend investing calculations that you should consider as you build and monitor your portfolio.

Here are three essential dividend investing calculations that you need to know:

- Annual dividend yield: Annual dividend yield is the calculation of the percentage of dividend per share received relative to the stock price. This is a great barometer of the annual income you receive from investing in a stock. For example, if you invest in a $50 stock and it pays $2 per share in dividends. This is equal to a 4% annual dividend yield. If you plan on living off dividends, you want the annual dividend yield based on the cost you invested in shares to be the highest as possible.

- Dividend growth rate: The dividend growth rate for a dividend stock is very important. I love investing in stocks that continually increase their dividend because I essentially get a ‘raise’ every year for doing absolutely nothing. You can calculate the dividend growth rate on any annual timeframe. To do so, take the current year’s dividend per share divided by last year and subtract 1. This will calculate the dividend growth rate compared to the prior year.

- Dividend payout ratio: The dividend payout ratio is a measure of how much a dividend stock pays in dividends relative to their earnings. You must consider the payout ratio of a stock because a high payout ratio means the company is retaining limited cash to be reinvested in the business. This can sometimes flash a red flag. If earnings decline, the dividend stock will have to decrease their dividend. That goes completely against our rules. We only want stocks that we know no matter what they will (at a minimum) maintain their dividend or increase it over time.

If you want to live on dividends, you must focus on the income component first. Make sure that the dividend will never decrease in value.

You need stability of the income and stock appreciation. Good stocks increase their dividend over time and the stock value appreciates as well. This is since the earnings are likely increasing as well.

Also, understand that you are lowest priority in the capital stack in the event of a liquidation since you are an equity investor.

You can track these statistics easily with sites like FINVIZ. GuruFocus or Investopedia. Sign up for GuruFocus and we will both get a free month of premium. I love their guru investor trackers to search for new investment ideas.

Once I find a new investment idea, I like to do a quick-and-dirty analysis with our free downloadable dividend discount model.

Use the three ratios to start building your dividend portfolio and choosing the right stocks for you, so… what dividend stocks should you look for?

Identifying the best long-term stocks for dividends

I’ve read tons of investing books including those from Benjamin Graham, Warren Buffett, David Einhorn and other legendary investors. One common parallel among them all is the notion that you should only invest in stocks that you understand.

I like to invest in businesses that I understand at undervalued prices.

I love running my stocks through a qualitative analysis that features a series of yes/no questions, including but not limited to:

- Shareholder Friendly: Has the company increased its dividend in the last 3+ years? (Yes or No)

- Financial Health: Does the Company have a modest dividend payout ratio? (Yes or No)

- Management Team: Was the current CEO hired internally? (Yes or No)

- Operational Excellence: Do they have a track record of revenue and earnings growth? (Yes or No) Has the company provided a long-term growth plan? (Yes or No)

- Business Model: Do you understand the business model? (Yes or No) Is there a significant moat around the company? (Yes or No)

Think of each ‘Yes’ answer as 1 point to your score. You certainly cannot have more than half of your questions answered as ‘No’ if a company is going to become a dividend growth stock for the long haul. Living off dividends means that you are positioning yourself for the best future success possible. That means you need to be invested in the best performing stocks of the future.

Even a better scenario would feature an outcome where you are a frequent customer of the company. Warren Buffett has been an investor in Coca-Cola since 1988 / 1989, which has generated over a +1,595.58% return since that time. Warren also drinks at least one Coca-Cola per day. This is a great example of dividends and dividend growth investing.

Talk about putting your money where your mouth is… If you want a visual depiction of how we look for stocks.

Check out my dividend stock screener infographic.

5 Steps to Invest for Passive Income with the Goal of Living Off Dividends

If you follow the rules for finding the best stocks for dividends, your dividend investing will be passive. As you build your portfolio over time, there is limited work needed to be done. All you need to do is ensure you have real-time notifications enabled for your dividend portfolio.

Can you earn passive income from investing? Absolutely, all you is follow these five steps to achieve the ultimate goal of living off dividends.

1. Contribute $200 per month to your dividend portfolio your first year

Set up an automatic contribution of $200 per month to your dividend growth portfolio. That should be an easy start. If you want to contribute more, even better! Make your contributions automated as much as possible. We want to save our time for other sources of passive income.

2. Increase your monthly contributions by 25% per year

This sounds like a lot but can be doable so long as you increase your income from other sources along the way. As long as you are a good saver, you should be able to do this for the first 10 years. After that the annual increases get much more difficult, but they are certainly attainable. I’ve been saving at least 30% of my after-tax income each year.

3. Any dividend income you receive should be reinvested into your dividend growth portfolio

Once you receive dividend income, use this to buy more stock in your portfolio. Rather than a dividend reinvestment plan, I like to invest at my own discretion. A dividend reinvestment plan will automatically buy shares in that specific stock. Without the dividend reinvestment plan, I can invest in a stock when it declines in value or I can invest in a different dividend stock in my portfolio.

4. Invest in quality stocks that enable you to achieve a 6% growth rate in your equity value

This point shouldn’t be hard to do. You will have some winners and some losers, but just make sure you have 6-8 winners out of every 10 stocks.

5. Repeat steps 1-4 as you go over time

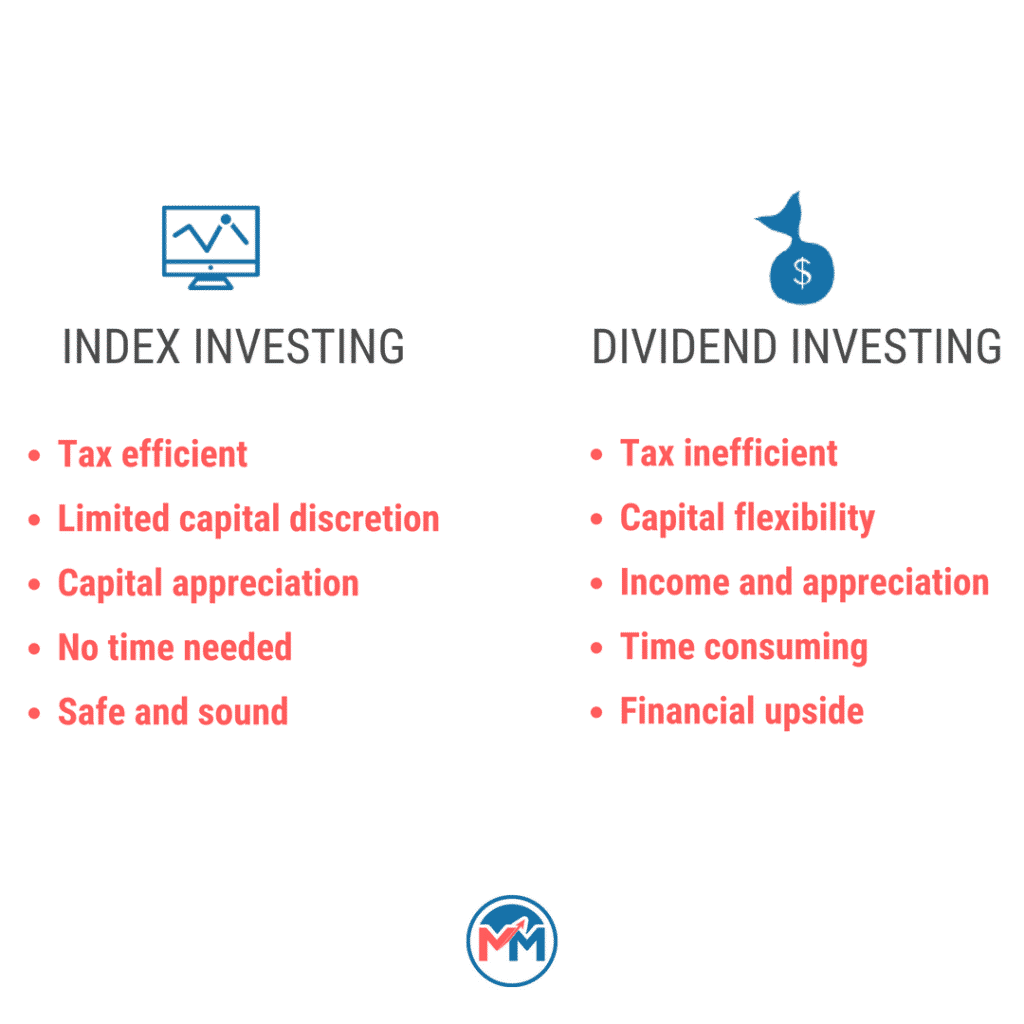

Continue with your plan and it will all work out. I like building a hand selected version of dividend stocks as opposed to index investing. This allows me to focus on specific yields and invest in companies at attractive valuations.

So, how do you truly get to the point of living off dividends?

Let’s look at a case study that validates the fives steps to living off dividends forever that I highlighted above.

This is bound to convince you that living off of dividends is realistic. If you follow the five steps to investing for passive income, you will see the amazing effects of the following:

- The power of compound interest

- The ability to achieve two goals in one… Your portfolio value increases over time AND you increase your income significantly

- By year 20, you have achieved a ~$100,000 annual passive income and an aggregate portfolio value of over $3 million dollars

Let’s get into our case studies surrounding what it takes to live off dividends.

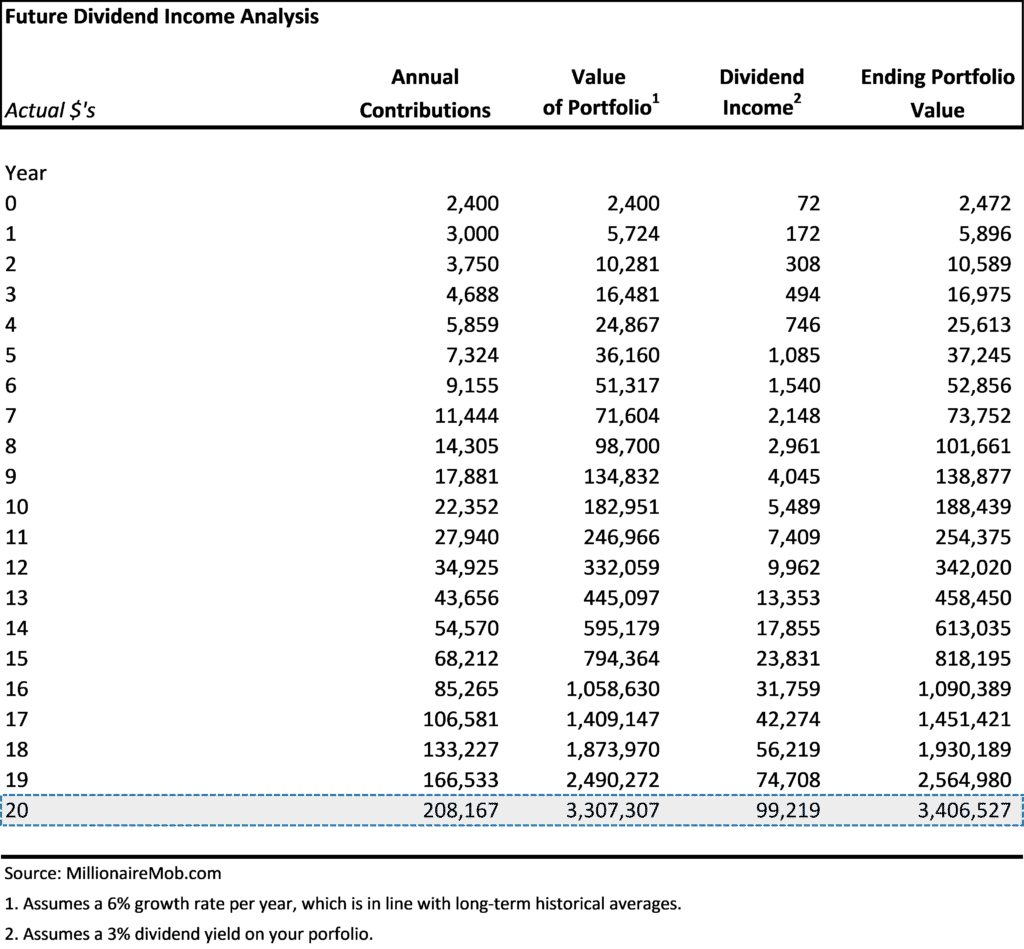

Scenario #1: Start off by Contributing $200 Per Month to Your Passive Income Dividend Portfolio

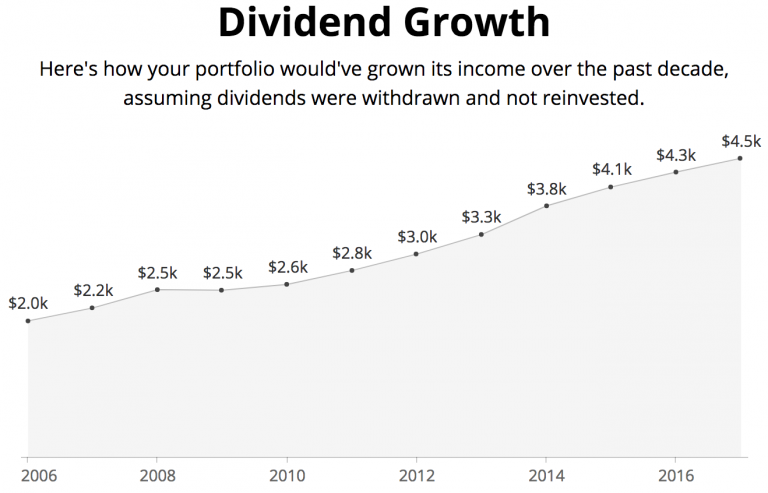

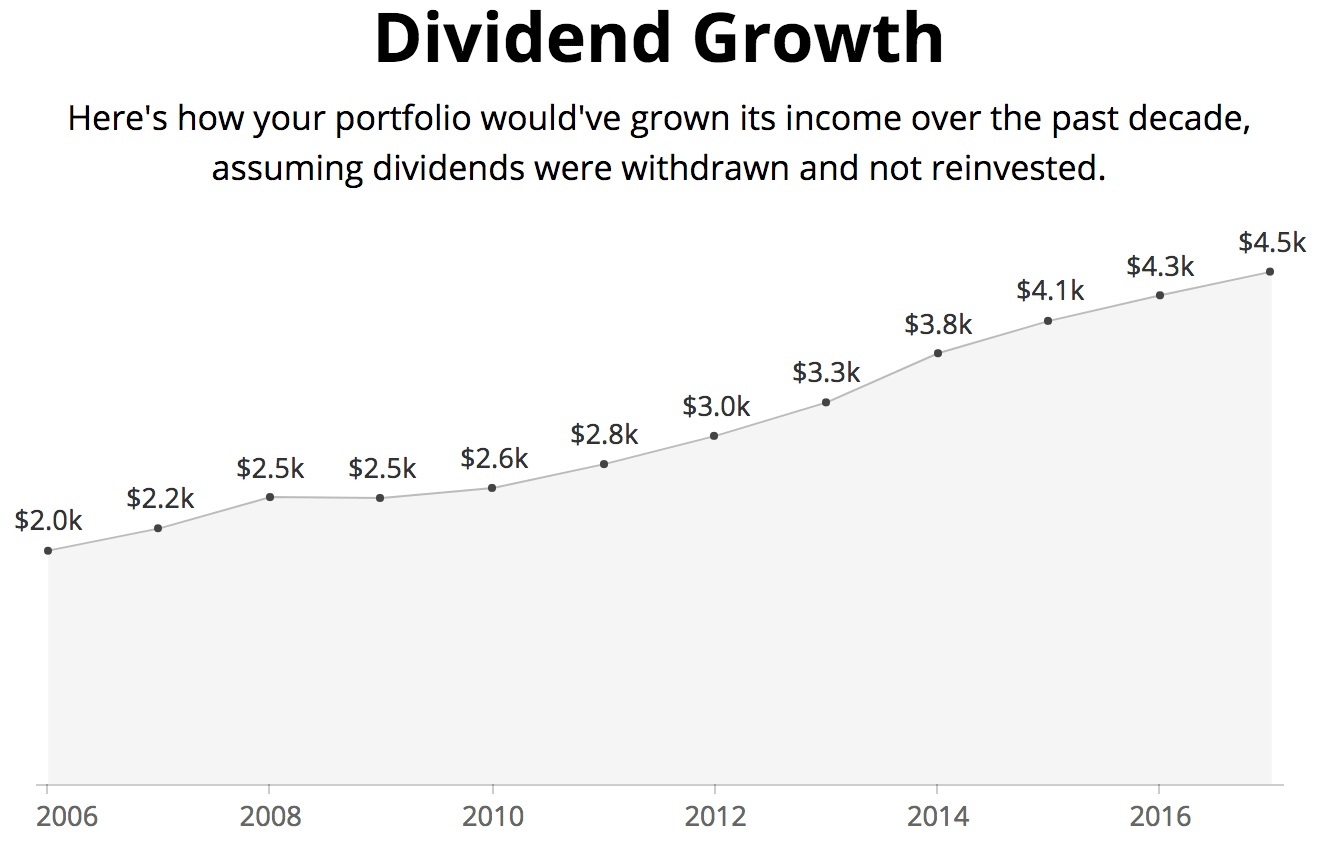

In the graph below, I show that you contribute $200 per month in your first year for a total annual contribution of $2,400. From there, you increase your annual contributions by 25% per year. Your portfolio appreciates in value as stocks increase in price at a rate of 6% per year.

Your dividend income received is 3% per year, which is very attainable. This is slightly above the average yield for the S&P 500.

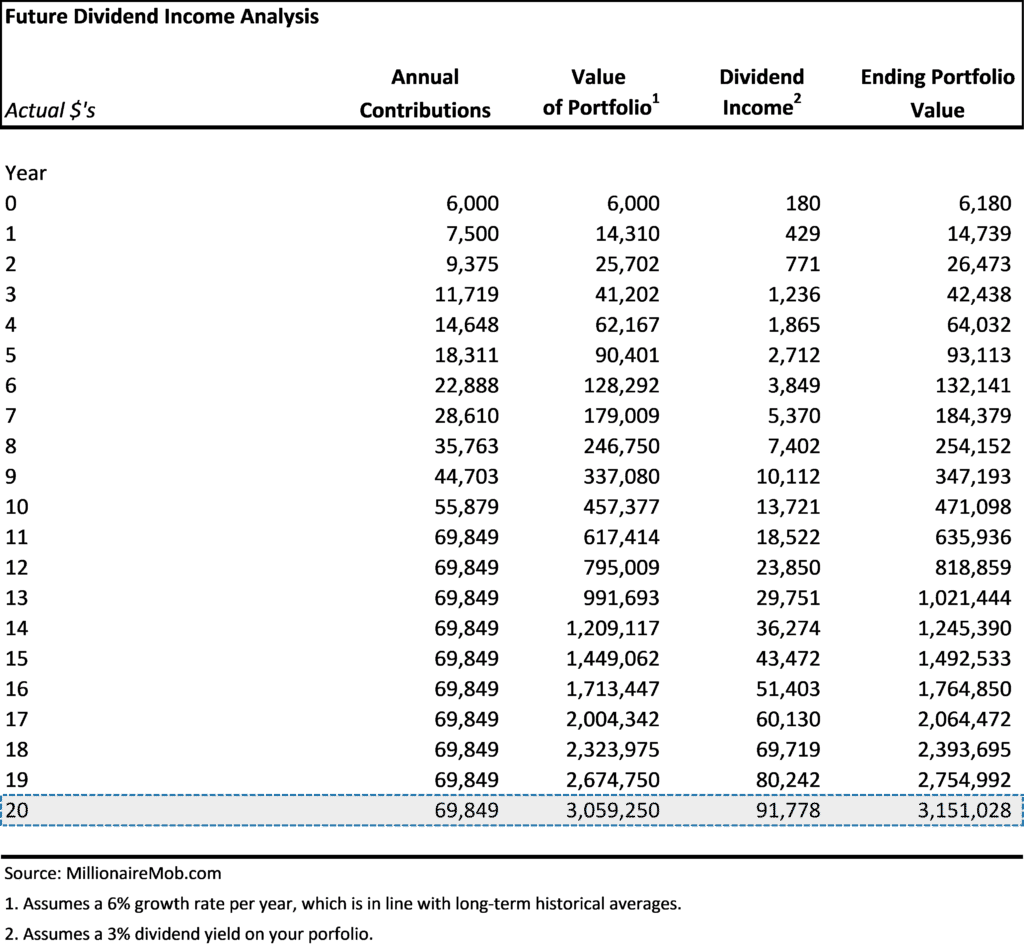

Scenario #2: Start off by Contributing $500 Per Month to Your Passive Income Dividend Portfolio

In the graph below, I show that you contribute $500 per month in your first year for a total annual contribution of $6,000. From there, you increase your annual contributions by 25% per year, but you max out your contribution $69,849 in year 11 and maintain that annual contribution thereafter.

This assumes the same assumption that your portfolio appreciates in value as stocks increase in price at a rate of 6% per year.

Your dividend income received is 3% per year, which is very attainable. This is slightly above the average yield for the S&P 500. This results in you achieving the same mark but contributing less in total contributions of only $953,889 total contributed in 20 years.

Test you own case studies by using our dividend calculator to calculate the future value of your portfolio and income.

You can download the dividend calculator below:

Key Takeaways from the Living Off Dividends Scenarios

A key takeaway for how to live off of dividends is twofold.

- Increasing your income and savings over time is paramount. You cannot reach maximum goals if you do not continually increase your income. If you don’t increase your income you can rely on my next point for living off dividends. You can increase your income by investing in real estate income properties. Or, you can increase your income without working more.

- Start early. You need to contribute as much as possible to your dividend portfolio as early as possible. From there, you should maintain an annual increase in your contributions. Stay organized and keep a log of your contributions and when you are due for an annual increase.

Investing for passive income should not be taken lightly though. You simply do not just invest in dividend stocks blindly. Get involved and stay focused on improving over time.

You should do your own due diligence in stocks that you invest in. The better you are at your due diligence the more your investment returns should increase. Imagine if your portfolio value increased at an annual rate of 10% per year. The benefits can be significant.

Are you going to start investing for passive income?

My case study shows that investing for passive income is achievable for anyone. More importantly, it shows that dividend growth investing for passive income is MOST IMPORTANT for the younger generations.

If all you need is 20 years to become a multi-millionaire that receives a six-figure income for doing absolutely nothing, you can retire safely at age 41 so long as you start at age 21….

Simply amazing.

On a time-adjusted basis, dividend investing is one of the most attractive value propositions out there. No questions asked.

Dividend investing is a way to earn passive income without working at all. Take the time to pay yourself first by investing to live off of dividends. Use dividend income tracking software to know when your dividends will come in. This will help you continually deploy additional capital.

Dividend investing opens the door the following considerations that are not commonly found with other passive income ideas:

- Obtain unlimited upside potential by investing in high-quality dividend stocks

- Realize the benefits of monthly or quarterly income

- As Albert Einstein once said, “Compound interest is the eighth wonder of the world.” Dividend investing is the best way to capture compound interest over the long haul and maximize your total return.

What will you do next to live off dividends?

Keep in mind dividend investing is additive to your current retirement goals. You should be contributing the max amount to your 401(k) and maxing out your Roth IRA / IRA annually. Then, proceed with a dividend investing portfolio. Start investing and evaluate what it will take for you to retire early.

If you want to retire early, you’ll need to supplant your current income since your retirement accounts cannot be touched until your later years. By building a successful dividend portfolio, you’ll earn additional income that also features residual value once you hit your age threshold for your retirement accounts.

I use Blooom to do a free 401(k) and IRA analysis to determine my proper allocation. This has been very helpful for me as I continue to invest in index funds for my 401(k) and focus on increasing my income with a dividend growth portfolio. You can live off dividends in early retirement and retirement.

Disadvantages of dividend investing

There are some things to consider as disadvantages of dividend investing. I always like to consider the cons side of the equation with investing for passive income. You tend to learn a lot more from the cons to strengthen your story on the advantages.

- Taxes associated with dividends: Oftentimes, we are taxed at a much higher bracket. If you are a high-income earning (like myself), you effective tax rate is 40-50% on your dividend income. I am taking a small hit on my taxes for a huge benefit for the future.

- Taxes associated with dividends debunked by Millionaire Mob: We are investing for dividend growth people. I hope that you are buying stocks now that will increase their dividend significantly over time.

- I don’t invest to increase my current income today. I increase my current income for tomorrow (aka early retirement). In addition, with dividend investing for passive income, we are striving to achieve our goal of early retirement. When we retire early by living off dividends, our tax bracket decreases significantly.

- Total return is always better: Another disadvantage of dividend investing for passive income is the fact that companies are usually better off investing that cash back into their business. I’ve seen a few articles arguing that Warren Buffett’s Berkshire Hathaway doesn’t pay a dividend for a reason.

- Cash reinvested by companies’ debunked by Millionaire Mob: Berkshire Hathaway is an investment company. For people that believe it is a conglomerate is purely wrong, Berkshire Hathaway is an investment manager.

- They acquire and invest in high-quality businesses to generate a return for their shareholders. In order to maximize the return, they invest every dollar of capital into these businesses to take advantage of compound interest. Yes, there are instances where companies are better suited to reinvest all cash into the business. Warren Buffett is a great example. He has led by example on this effort and by my book, he deserves to invest every dollar into dividend-paying companies. Warren Buffett loves dividends.

- Further debunked myth, companies are generally not better off reinvesting cash back into the business. How about Twitter acquiring Vine just to shut it down? Prudent use of cash? Highly doubtful. Huge CEO bonuses are a prudent use of cash? I don’t think so.

The advantages of investing for passive income far outweigh the disadvantages. I love dividends. I also love increasing my nest egg for retirement. At some point, I will be able to live off my dividends completely. At the right time, you can then sell the dividend stocks in your portfolio to live off of that nest egg for the rest of your life.

I’ve highlighted why I believe you want dividends over growth investing. A growth stock is a share in a company whose earnings are expected to grow at an above-average rate relative to the market.

Growth stocks don’t typically pay dividends, because the companies would much prefer to reinvest the earnings in their own company. These stocks are a little riskier since they are reinvesting cash flow into a business that is unsure of proper capital allocation. Dividend stocks are proven companies that continue to deliver excellent financial performance.

Back to that killing two birds with one stone…

I love dividends

Fund managers and institutional investors love dividend paying stocks. Companies that pay dividends are a vote of confidence to the professional investing community that they are confident in their ability to increase earnings and confidence in their ability to increase their dividend. A win-win around the table.

Share repurchases also signal confidence but offer more flexibility because they don’t create a tacit commitment to additional purchases in future years. When you get both share repurchases and dividends, you unlock some outstanding benefits.

For now, continue to invest in a dividend portfolio to increase your income AND save for retirement. Your future self will thank you. You’ll want to track your dividend income using these software tools.

I love dividends so much that… I created a book called Dividend Investing Your Way to Financial Freedom

I think dividend investing is often misrepresented amongst the investing and financial freedom community. There is so much to learn from dividend investing and my approach.

Dividend investing is a fantastic way to build wealth through compound interest. Dividend investing is not the only strategy in the world. However, I believe that if you can combine value investing with dividend-paying stocks, you can achieve a compelling total return.

I created a dividend investing book to help you:

- Improve your portfolio returns

- Understand the pros and cons of a dividend investing approach

- Develop and craft your own dividend investing strategy

- Build wealth through a long-term compound interest plan

That is why I created Dividend Investing Your Way to Financial Freedom.

You can buy the book on Amazon

Check out on Amazon to buy the book if you wish! I think you will learn a lot. If not, here are 12+ other top dividend investing books to consider.

Follow Millionaire Mob’s dividend growth investing journey

Follow along on my dividend growth investing journey to get the latest and greatest updates on our dividend growth portfolio. I am building a dividend income portfolio from scratch that everyone can follow along.

Passive income dividend investing takes a lot of upfront work, but features massive benefits.

Are living off dividends? Do you have any questions that you’d like addressed? Let me know in the comments below. I’d love to hear from you. Our wealth management resources will help you plan and execute on your financial future. Good news is that they are all free.

Related Resources

Millionaire Mob is where people come together to find the best travel deals and financial advice. We specialize in dividend growth investing, passive income, and travel hacking. Our advice has helped thousands travel the world and achieve financial freedom. With both a million rewards points from travel hacking and a million dollar net worth, you can live a happier lifestyle.

Follow me on Twitter, Facebook or Instagram to get the latest updates on our investing for passive income journey. If you are an avid stock fan, follow us on Stocktwits to get my investments in real-time.

Subscribe to the Millionaire Mob early retirement blog newsletter to find out the best travel tips, dividend growth stocks, passive income ideas and more. Achieve a financially free lifestyle you’ve always wanted.

Join our community of mobsters seeking financial freedom. What are you waiting for?

How to earn passive income: 15 ways to consider

These celebrities know how to invest! Time

For many people, toiling for a living isn’t fun.

There can be lengthy commutes, dress codes, annoying coworkers, unreasonable supervisors, taxing physical labor, insufficient vacation time, heavy workloads, and a lack of appreciation, among many other things.

Thus, it’s easy to dream of money just arriving, without our having to clock in to earn it. Fortunately, passive income streams don’t have to be a dream. There are many sources, with examples including REIT dividend income, residual money, real-estate investments, interest, and other income-generating assets. Here’s a look at 15 of them — see which opportunities could work for you.

1. Stock dividends

One of the simplest ways to enjoy passive income streams is to buy stock in healthy and growing companies that pay dividends. Better still, look for dividends that have been increased regularly at a good clip (many companies often hike their payouts annually) and that have room for further growth, as evidenced by a dividend payout ratio of around 70% or less. The payout ratio is the amount of the annual dividend divided by the trailing 12 months’ earnings per share. It reflects the portion of earnings being paid out in dividends. The lower the ratio, the more room for growth. A ratio above 100% means the company is paying out more than it earns, which isn’t too sustainable. Here are some examples of stocks you might consider and research further:

|

Stock |

Recent dividend yield |

|

AT&T |

5.3% |

|

National Grid |

5% |

|

Duke Energy |

4.5% |

|

Verizon Communications |

4.5% |

|

Pfizer |

3.7% |

|

Flowers Foods |

3.5% |

|

General Motors |

3.4% |

|

China Mobile |

3% |

Data source: Yahoo! Finance.

2. REIT dividends

Another kind of dividend to collect is from real estate investment trusts, or REITs. They’re companies that own real-estate-related assets, such as apartments, office buildings, shopping centers, medical buildings, storage units, and so on — and they are required to pay out at least 90% of their earnings as dividends. They aim to keep their occupancy rates high, collect rents from tenants, and then reward shareholders with much of that income. If you’re interested in real estate as a way to make money, check out these examples of REITs to consider as investments:

|

REIT |

Property focus |

Recent dividend yield |

|

Iron Mountain |

Document storage |

6.6% |

|

Welltower |

Healthcare |

5.9% |

|

Realty Income |

Retail |

5% |

|

Public Storage |

Storage units |

4.1% |

|

Host Hotels and Resorts |

Hotels |

3.9% |

|

Digital Realty Trust |

Data centers |

3.5% |

Data source: Yahoo! Finance.

3. Stock appreciation

Another way to wring income out of stocks, even if they don’t pay dividends, is to buy stocks that you expect will appreciate in value over time and then, when you need income, sell some shares. If you have a fat portfolio of such stocks when you retire, you might sell some shares every year to create a cash stream for yourself. Studying and choosing the stocks that will perform very well for you is easier said than done, though, so if you don’t have the interest, skills, or time to become your own stock analyst, consider simply investing in a low-fee broad-market index fund or two, such as one based on the S&P 500. Here’s how much you might accumulate over several periods if your investments average 8% average annual growth:

|

Growing at 8% for … |

$5,000 invested annually |

$10,000 invested annually |

$15,000 invested annually |

|

10 years |

$78,227 |

$156,455 |

$234,682 |

|

15 years |

$146,621 |

$293,243 |

$439,864 |

|

20 years |

$247,115 |

$494,229 |

$741,344 |

|

25 years |

$394,772 |

$789,544 |

$1.2 million |

|

30 years |

$611,729 |

$1.2 million |

$1.8 million |

Calculations by author.

4. Interest

Among the many passive-income opportunities that exist, interest is a very popular one, along with dividends. Unfortunately, we’ve been living in an environment of ultra-low interest rates for many years now, so even a savings account with $100,000 in it might only grow by $1,000 or $2,000 per year. Interest rates seem to be rising, though, so take heart — and know that in many past years, bank accounts and CDs and bonds have paid rates of 5%, 8%, and even 10% or more.

5. Annuities

While stocks are terrific income producers, they can be volatile. Every few years, the stock market tends to stagnate or drop for a while before recovering, and that can be problematic if you were counting on your stocks having a certain value at a certain time. One way to lock in an income stream is by buying a fixed annuity (as opposed to variable or indexed annuities, which can have steep fees and overly restrictive terms). Annuity contracts will be more generous when interest rates are higher, but here’s how much income they might deliver at recent rates:

|

Person/people |

cost |

Monthly income |

Annual income equivalent |

|

65-year-old man |

$100,000 |

$541 |

$6,492 |

|

70-year-old man |

$100,000 |

$620 |

$7,440 |

|

70-year-old woman |

$100,000 |

$579 |

$6,948 |

|

65-year-old couple |

$200,000 |

$921 |

$11,052 |

|

70-year-old couple |

$200,000 |

$1,019 |

$12,228 |

|

75-year-old couple |

$200,000 |

$1,160 |

$13,920 |

Data source: immediateannuities.com.

6. Rental property income

Income-generating assets are another of many passive-income opportunities. A classic example is making money in real estate via owning rental properties. It can seem perfect: You buy an apartment building or house, rent it out, and then sit back and collect checks every month from your tenants. The reality isn’t always so rosy, though. For one thing, you’ll need to maintain and repair the property, as well as paying taxes on it and insuring it. It may not always be occupied, either. You may have trouble finding tenants, or finding tenants who pay their rent reliably. Some tenants may damage the property, and others may be hard to get rid of. You’ll be the one they call in the middle of the night if the roof is leaking, and you’ll have to clean and perhaps freshen up the property between tenants. You can outsource much of this to a property management company, but it will take a cut of your income, often about 10%.

7. Pay off debt

You might not think of paying down debt as an income-generating activity, but it kind of is. Think of it this way: If you owe $10,000 and are paying 20% interest on it, that’s $2,000 in interest payments annually. Ouch. Pay off that $10,000, though, and you’ll be keeping that $2,000 in your pocket. It’s very much like earning a guaranteed 20% return on the debt that you retire, and 20% annual returns are way more than you can expect from the stock market or elsewhere. Note that some credit cards may be charging you 25% or even 30% interest, so paying such debt off as soon as possible is a no-brainer financial goal.

8. Credit card rewards

Speaking of credit cards, if you don’t use them to rack up debt, you can instead use them to generate income streams for you — via their cash-back or rewards programs. Some cards offer flat-rate cash-back percentages up to about 2%. Others target certain kinds of spending or certain retailers. If you spend a lot at Amazon.com, for example, you can get a card that rewards you with 5% cash back there — which can really add up. (It’s not hard to spend $250 per month at Amazon, which is $3,000 per year — enough to earn $150 back.)

Other stores with associated credit cards include Target, Costco, Gap, Lowe’s, TJX, Toys R Us, and Wal-Mart. Many offer 3% to 5% in cash back or discounted prices, and many offer other perks, too, such as free shipping on items purchased at the sponsoring retailer, while others might let you return items without a receipt, or will donate money to charity whenever you use the card. If you travel a lot, you can use travel-related credit cards to rack up lots of points and rewards that can be used instead of cash, keeping more cash in your pocket.

9. Residual and royalty income

You can also generate residual and royalty income for yourself by producing things that might then pay you again and again. This isn’t 100% passive income, as there’s some initial work involved, but if all goes well, once you’ve done the work, you’ll be paid repeatedly over a possibly long period of time.

For example, you might take photos and have them available for a fee at sites such as shutterstock.com or istockphoto.com. Similarly, you can create and upload designs at sites such as zazzle.com and cafepress.com, where people can buy them imprinted on shirts, mugs, and so on. Similarly, if you write an e-book (which can be as short as 6,000 or so words), you might find that people are interested in buying it, perhaps via Amazon.com’s direct publishing service.

10. Sell stuff online

Speaking of selling stuff online, that’s another mostly passive way to generate income. You could generate an income stream for a while by clearing out your basement or attic and selling items on eBay or elsewhere. This can be especially effective with collections. If you have lots of games or jigsaw puzzles that are taking up space and not being used, they can be great sources of income. You might reap a lot by selling new and used clothing you don’t need.

11. Rent out space in your home

Not everyone is eager to do this, but consider renting out space in your home for extra income. You could take in a full-time boarder, for example, but you needn’t be that extreme. Instead, consider renting out an extra room via a service such as airbnb.com or homewaway.com. If you do so for just 20 nights a year and charge $100 per night, that’s $2,000 in pre-tax income! If your home is in a desirable spot, maybe you can rent out the whole house for just two weeks in the summer, charging $2,000 per week and collecting $4,000.

12. Lend money

Here’s an option that’s still unfamiliar to many people but that has been growing in popularity: Lending money on a peer-to-peer basis. A major website for this is lendingclub.com, where investors have earned returns in the neighborhood of 4% or more annually. You’ll be lending money to fellow individuals who have had trouble borrowing money through other avenues, and you can spread your dollars across many such folks to reduce the risk.

13. Refinance your mortgage

Refinancing your mortgage is a passive income generator? Yup, it sure can be. If you’re making monthly mortgage payments of $1,600 now, and you can reduce that to $1,300 per month by refinancing your home loan at a lower interest rate, you’ll keep $300 in your pocket each month. Of course, refinancing isn’t free — there are closing costs. Still, if you plan to stay in your home long enough to more than break even, refinancing is well worth it. As an example, if your closing costs are $6,000 and you’re saving $300 per month, you’ll break even in 20 months — less than two years!

14. Get a reverse mortgage

Refinancing may not be worth it to you, depending on your situation and interest rates, but maybe a reverse mortgage is just what you need. It’s typically an option well worth considering for those in or near retirement. A reverse mortgage is essentially a loan, with the amount borrowed not having to be repaid until you die, sell your home, or stop living in it (perhaps because you moved to a nursing home or died). At that time, the home can be sold to cover the debt — or your heirs can pay it off and keep the home. Reverse-mortgage income is often tax-free, which is another big plus. The amount you get can be delivered in monthly installments, providing very passive and reliable income in retirement.

15. Affiliate marketing

If you have a blog or some other property that has visitors, you might profit passively via affiliate advertising. For example, imagine that you write a blog about movies. You might review some books about movies, and then link to them on Amazon so you get a cut of the purchase price when anyone buys books through the links. If you blog about hiking, you might promote some hiking gear you recommend on the blog, again generating passive income if anyone buys any of it.

These are some of the main ways to earn passive income for yourself. There are others that you can find by doing further online exploration. (For example, you might agree to have your car wrapped in an advertising message and then collect cash just for driving around town in your own vehicle.)

Consider some of the ideas above, because the income they offer might significantly improve your retirement or help you achieve other important financial goals. Some of them might even turn out to be fun.

Charity Oxfam says four out of every five dollars of wealth generated in 2017 ended up in the pockets of the richest one percent, while the poorest half of humanity got nothing. Newslook

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Selena Maranjian owns shares of Amazon, Costco Wholesale, National Grid, Realty Income, and Verizon Communications. The Motley Fool owns shares of and recommends Amazon, eBay, National Grid, and Verizon Communications. The Motley Fool recommends Costco Wholesale, Lowe’s, The TJX Companies, and Welltower. The Motley Fool has a disclosure policy.

The Motley Fool is a USA TODAY content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. Its content is produced independently of USA TODAY.

Offer from the Motley Fool: The $16,122 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $16,122 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

Read or Share this story: https://usat.ly/2GmrN8k

The Secret That Can Turn $2,500 into $1 Million or More

Bob Lilly is a 53-year-old supply chain manager from Connecticut.

Like most investors, he’s always been fascinated with the stock market.

He started dabbling with traditional “buy and hold” investing in his 20’s, but never could never quite turn a profit on his own.

Eventually, he started to lose more than he made – discouraging him from investing in the markets at all.

If Bob’s story sounds familiar to you… I’m not surprised.

A lot of folks that I’ve met over the years share the same investing origins as Bob – forcing most of them to pull their money out of the markets and head for the sidelines.

Luckily, Bob wasn’t willing to give up on his financial dreams just yet…

He started using Wall Street Probe system.

And after a “soured” history in the markets, Bob was able to pocket a $2300 profit on his very first trade using my system.

“Love it! This is a fantastic way to start. I’m putting those profits to work now… I just placed my second trade.”

Bob came to Wall Street Probe looking for a way to change his financial future… And, from the beginning, we’ve been there to guide him along the way…

“I love the education this service gives me…I watch your training videos before I go to bed on my iPad!”

After using my secret for a few weeks, Bob is now working towards amassing $100,000 this year to help his children with their student loans – his first goal on his journey to reaching a million dollars.

There’s a reason why I’m sharing Bob’s story with you today…

His story is the perfect example that achieving your financial dreams, becoming a millionaire and amassing wealth you never thought possible, is 100% attainable.

“With this system, I could see me reaching my goals sooner rather than later!”

Truth is, becoming a millionaire isn’t as complicated as people think it is.

And it doesn’t have to be a lofty pie-in-the-sky dream…

It’s an easily attainable goal that everyday investors like you can achieve.

My mission here at Wall Street Probe is to show you that by taking a small, underperforming part of your portfolio- and applying it to my 10-minute system – you can grow your wealth exponentially. Even reach millionaire status in just a few short years.

And once you understand the basics, it really only takes 10 minutes to set up everything you need to make our Wall Street Probe trades work. That’s it – 10 minutes.

That might sound impossible – especially if you’re still learning the ropes when it comes to investing. But that’s exactly what makes my system so groundbreaking.

I’ve streamlined and simplified everything for you so even investors who are just getting their feet wet can utilize Wall Street Probe to beat the markets and catapult themselves into millionaire status.

By stringing together a consistent series of gains in rapid-fire succession, you have the power of compounding with you like a wind at your back.

Here’s an example – using a very, very modest return. Let’s say you string together a series of small 4.0% gains every two weeks.

| As Wall Street Probe investors, our goal is to make as much money as possible on each trade. Historically, this system has scored an average 134% gains every 15 days on winning trades. But as this chart illustrates, even a modest investment and a consistent string of small gains will put you on the path toward your first million dollars faster than you would have ever thought possible. |

In less than 6 years, you could turn a mere $2,500 commitment into a whopping $1 million.

And that’s being ultra conservative.

Because with my system, we’re not aiming for mere 4% gains – we’re aiming much higher… 50%, 100%… even 200% on a consistent basis.

In fact, using this very system, folks in my VIP Trading service just cashed out 16 triple-digit winners in less than 60 days.

| Jan. 5: | 100% |

| Jan. 9: | 200% |

| Jan. 11: | 104% |

| Jan. 25: | 100% and 113% |

| Feb. 3: | 122% win |

| Feb. 10: | 112% win |

| Feb. 13: | 200%, 200%, 112%, and 107% |

| Feb. 24: | 100% and 114% |

| March 1: | 200% and 159% |

| March 2: | 220% |

So, you can see, with a string of winners like these how quickly you could double or triple – even quadruple – your retirement account and get closer to achieving millionaire status

This is how you go from an initial starting stake of $2,500 to a million dollars very quickly. You just reinvest a portion of your earnings back into each new trade, – and next thing you know you have a million dollars in the bank. That’s what happened to me.

How do I keep getting winners?

That’s the secret that I’ll reveal in just a minute, but suffice it to say that I’ve learned to turn the irrational market psychology that torpedoes so many other traders to my advantage. I’ve learned through years of study and hard work, trial and major errors, what the true nature of the markets really are. I’ve pierced the veil and seen behind the curtain.

Fact is, the markets are not some impersonal and all-powerful force. The markets are driven by human beings pulling the levers. These humans – and I mean each and every one of them including me and you – have hard wired flaws in their brains that cause them to do crazy,

Let me give you a quick example in the form of a thought experiment.

Let’s say I were to flip a coin six times in succession and record the results where H is heads and T is tails. Which of the following three sequences do you think is more likely to occur?

- H-T-H-T-T-H

- H-H-H-T-T-T

- H-H-H-H-H-H

If you answered Result No. 1, you’ve got lots of company: It’s how most people respond to this question. Coin tosses are by definition random. Result No. 1 seems more “random” than the others. Heads and tails alternate (more or less), which is internally consistent with our concept of a 50-50 chance.

A streak of three heads in a row (Result No. 2) seems less likely. Flipping six heads in a row (Result No. 3) seems completely impossible.

Here’s the stunner …

Each of these three scenarios has an equal chance of happening.

By that I mean that each of the three has the same probability – exactly one in 64 – of occurring.

If you don’t believe me, check the math. Each coin has a 50% chance of landing heads or tails. So over six tosses, there are precisely 64 possible combinations of results given by the equation:

1 ÷ ( ½ × ½ × ½ × ½ × ½ × ½ ) = 64.

Go ahead. Break out your calculator and run the numbers yourself.

If this seems absurd, you now know firsthand one of the biases that traders fall prey to every day. The human brain is great at seeing patterns – especially in small samples of data. And we’re terrible at calculating probabilities.

To see how this plays out in the stock market, let’s transform Heads to Wins and Tails to Losses. When faced with a short string of losing trades (e.g. L-L-L-L-L-L), most traders react in a very predictably irrational way.

They assume the “trend” is bound to reverse on the next trade or “regress to the mean” (something called the “gambler’s fallacy”). They start risking more and more on each successive trade recklessly throwing money into the market hoping that this so-called “trend” will reverse itself.

This reaction is a mistake.

A BIG mistake. But it’s also a mistake that we can profit from. Handsomely. Over and over again.

By running a system like mine that neutralizes irrational biases in ourselves and exploits them in others, we play on the winning side. Their biases become our gains.

The system is so simple anyone can use it – regardless of experience or background.

Think of it this way, in the U.S. there are approximately 4,500 stocks traded on any given day…

But, in reality, only a tiny portion of those stocks will make you money.

So my system basically says: forget about what you read on Yahoo Finance, or the Wall Street Journal, or hear about on Fox Business – or CNBC.

None of that matters…You’re just wasting your time and your money. (Exactly what our friend Bob Lilly found out the hard way.)

My system squeezes out the emotion… filters out the noise… jams down the risk… and maximizes the potential for profits by pinpointing which handful of stocks are going to go up in any given week.

This isn’t an algorithmic “black box.” It’s not “robo-trading.”

It works by screening for market anomalies that pop up every single day.

I call these anomalies extremes.

Truth is, financial markets run to “extremes.”

You see, markets are made up of people… meaning they’re also a compilation of emotions… of fear… of greed… of predispositions… of likes and dislikes.

And you can exploit these extremes for hefty profits … often at risk levels that are well below normal.

And because emotions govern markets, they have a tendency to overrun at tops and overrun at bottoms.

And you can exploit these extremes for hefty profits… often at risk levels that are well below normal.

Like I mentioned, market extremes aren’t just once-in-a-while opportunities that come along when the prices of individual stocks, business sectors, geographic economies, or entire asset classes get out of whack.

You can find these extremes everywhere in the market – all the time.

They show up in broad indices…

They show up in specific market sectors…

They show up in stocks and bonds…

And this reality opens up a plethora of profit opportunities – on the “long” side and the “short” side.

But I’m going to let you in on a little secret… one that will short-circuit any fears you have – and ease your journey to Wall Street Probe status.

And here’s the secret.

There are really only three market extremes we have to find.

And each extreme has a unique “how often” and “how much” profile.

That means, with the full extent of Wall Street Probe system, you’ll know “how often” each extreme shows up in the financial markets. And “how much” you can expect to make from a trade properly executed against each extreme.

And it only takes 10 minutes to execute.

Let’s look at them together…

Market Extreme No. 1: Extreme Turnarounds (Pop & Drops)

| Pop and Drops: Occur Most Frequently Fast-Paced Profits Happen in a Short Time Frame |

Pop and Drops are the most common type of extreme you will see in the market.

These types of extremes appear when a stock is locked in a “sideways” trading range but the security beneath it is experiencing an extreme low or an extreme high.

Finding stocks trapped in these narrow ranges can lead to two kinds of profits – Pops (when the stock snaps back from an extreme low and shoots higher) or Drops (when the stock experiences a pullback from an extreme high and heads lower).

On the following page is an example of a “Pop and Drop” extreme that my VIP trading service subscribers profited from…

You can see the “hit and run” nature of these types of short-term trade. They are fast, fun and profitable.

Market Extreme No. 2: Extreme Continuations

| Extreme Continuations Occur with moderate frequency. Offer moderate-to-large profit potential. Happen in an intermediate-term time frame. |

This next type of extreme occurs in two flavors – Strong Stock Continuation and Weak Stock Continuation which mirror each other.

The difference being, in the Strong Stock scenario, a security has been trending up – but has then pulled back to a mid-term extreme on minor news (or no news at all). This positions the stock to rocket higher.

In contrast, the Weak Stock scenario is when a stock that is in a downtrend is pushed up to a mid-term extreme on minor news (or no news at all). This positions the stock to drop like a stone.

On the following page is an extreme continuation looks like on a chart…

These types of extremes tend to appear more moderately but still offers huge profit potential.

Market Extreme No. 3: Extreme Reversals

| Extreme Reversals Occur less frequently. Offer the biggest profit potential. Happen in a longer time frame. |

Our final extreme is Reversals.

These are the rarest type of extremes you’ll see but, more often than not, packs the biggest punch when it comes to profits.

Now, like our previous extremes, Reversals comes in two flavors – Oversold (Extreme Lows) and Overbought (Extreme Highs).

You can see both on this chart.

Let’s start with Oversold…

Extreme Oversold Reversals are when the stock or market has plunged, pushing the price level down well beyond what is reasonable – meaning it’s poised for a spring back to the upside.

With these kinds of extreme reversals, we’re looking at something that’s plummeted to an extreme, so much so that the price is poised for a snapback to the upside.

Again, thanks to the general bias to the upside, stocks, sectors, and indexes tend to bounce back sharply after a major drop.

In fact, 18 of the 20 largest single-day up moves in the Standard and Poor’s 500 were the result of Extremely Oversold snapbacks during massive bear moves.

Now let’s look at Overbought.

The extremes of this flavor that are the easiest to identify and occur when the price of the stock or financial asset has gone straight up (up too far and too fast) – meaning it’s poised for a pullback or snapback.

Before we move on, Extremely Overbought Reversals have one characteristic that must be understood. Because investors have an optimistic bias (meaning prices have the same predisposition), individual stocks, sectors, and even entire markets can stay overbought for some time.

Now, just being able to find these extremes in the market already puts you leagues ahead of the rest of Wall Street, but recognizing the extreme when you see it isn’t enough to help you reach millionaire status.

You need to put it all together.

And that’s where Wall Street Probe method comes into play.

I’ve centered Wall Street Probe around a simple 3 step fast track plan designed specifically to help you pinpoint these extremes and have a chance to play them for extraordinary gains..

- Find the Extreme

- Frame the Trade

- Book the Profits

You’ve already been introduced to step 1 – Find the Extreme.

Finding the target is all about uncovering an extreme in a stock that is ripe for the picking. Now, remember, these extremes could be Pop & Drops… Continuations… or Reversals. . Here at Wall Street Probe, each week I will guide you through how to identify when a particular opportunity is out of whack – has achieved an extreme – and the precise moment when the odds of initiating a profitable trade are overwhelmingly in your favor.

But it doesn’t stop there.

Once we’ve narrowed in on our target, we maximize our probability of success by “Framing the Trade.”

Truth is, knowing which stock to play is only half of the battle. You also have to know exactly when to get into the trade – and how to set it up to minimize risk.

My Wall Street Probe system takes the guessing game out of the equation.

Through a combination of contingency exits (stop-loss orders), and proper position sizing, we are able to maximize our profit opportunity while limiting downside risk for each trade.

That means, once all factors are defined and locked down, you’ll be ready to put on the trade decisively and with confidence.

After that, take a deep breath and relax.

You’ve done good work getting to this point.

You’re now in the trade, properly framed.

And you got there by following Wall Street Probe system.

You’ve found an extremely oversold trading opportunity, planned your contingency exit, sized the position, and put on the trade.

You’re now poised to realize optimum edge on a stock that has a high probability of snapping back for a big gain.

But you’re also protected by stops that were put in place to hold any unexpected losses to an acceptable level.

Like the long distance runner heading into the final turn, the bulk of the race is successfully behind you.

To collect your prize, however, you still need to make it across the finish line.

That brings us to our final step of our 3-part system: – Book the Profits.

My system helps you discover exactly when to take your profits, escape the scene, and move on to your next trade.

You see, even though we now have a handful of extreme stocks – specifically, those we believe have the highest probability for a snapback – we’re not just going to race ahead and start putting on trades.

As is true of every step in this process, we first want to plan our next move.

Specifically, we need a predetermined exit plan.

Our goal of course is to exit with a big win. And my third step Book the Profits will show you how to capture the biggest gains possible.

However, no trader is perfect every time. There are going to be trades that don’t go our way.

In those cases, we should do everything we can to limit our losses. This third step covers that too.

In virtually any potentially high-risk activity you can think of, participants don’t move until they have their exit plan in place.

An escape route.

A Plan B.

A backup plan.

Call it whatever you wish, but here’s the reality: if you know you’re involved in a risky situation, it pays to take extra precautions.

As you can see, it’s as simple as 1-2-3.

Now that you’ve seen the 3- steps in our Wall Street Probe system, let’s look at a couple of examples from beginning to end…

This was what I call a classic “rubber band” play.

It’s a relatively common occurrence where a stock gets pulled and stretched way off of a reasonable price level by trader’s herd mentality.

Experience has taught me that stocks in this condition snap back for big profits over and over again.

For example, look at this chart for 3D Systems Corp. (NYSE: DDD)

You can see the Extreme Pullback occurring on the far right, around Sept 1. I had successfully Found the Extreme…

Next, using a few simple formulas I’ve developed I “Framed the Trade” to maximize my probability of success.

In this case, my system indicated a stop-loss order be placed at $13.25 on my 250-share long position at $14.21.

At this point, I had virtually unlimited upside potential with concrete downside protection to limit my loss (should something go unexpectedly whacky).

At that point, less than 10-minutes after my initial scan, I was in the market with a properly framed Extreme trading opportunity. Trusting my system completely, I could walk away, live my life and forget about stocks for the rest of the day.

Over the next few days and weeks, the stock rebounded exactly as expected.

On September 30th, my system generated a definitive Sell signal so I “Booked my Profit.”

And what a profit it was. I ended up grossing $935.00 on a $3,500 investment. That’s more than a 26% return in four weeks – or an annualized gain of 1682.5%.

These opportunities happen all the time, in every market, in every week and month of the year.

Here is another rubber band play from January.

On Jan. 18, I successfully found the extreme… PNC Financial Services Group (NYSE: PNC), which was in the midst of a broad sector pullback.

Once I identified the target, my system then “Framed the Trade” by putting in a stop-loss order at $109.79 on our long position at $115.57.

Like our last example, I had virtually unlimited upside potential with concrete downside protection to limit my loss.

At that point, less than 10-minutes after my initial scan, I was in the market with a properly framed Extreme trading opportunity.

Over the next few days and weeks, the stock rebounded exactly as expected.

On January 25th, my system generated a definitive Sell signal so I “Booked my Profit.”

The truth is, what I’m showing you here in this report, is just scraping the surface.

Every week at Wall Street Probe, we will go into far more details on how to find extremes and make these life-changing trades.

In my notes to you each week, I will personally guide you through the different facets of this Wall Street Probe system. I’ll show you how to establish goals and stick to them. I’ll demonstrate how to adapt my strategy to your circumstances. I’ll guide you through the three moving parts of my system – so you’ll get to see, up close and personal, how simple it really is.

I’ll teach you how to Find the Extreme – identify when a particular opportunity is out of whack – has achieved an extreme – and the precise moment when the odds of initiating a profitable trade are overwhelmingly in your favor.

I’ll show you how to “Frame Trades” and “Book Profits.”

My system is so simple that you’ll learn how to execute these steps, and execute them quickly.

And there will be endless opportunities to capitalize on them.

In fact, I just put the final touches on my first recommendation. It’s a big one.

I found an extreme in the market that could make you a lot of money – and fast.

It will be released this week. I’m going to send it directly to your inbox.

So don’t forget to check for Wall Street Probe tonight and tomorrow

Living off Dividends in Retirement

Before zeroing in on any particular strategy or investment vehicle, retirees need to understand how much risk they are willing to tolerate in the context of their entire portfolio and the corresponding rate of return that can reasonably be achieved.

While each of us will ultimately reach different conclusions and asset allocations, we are united by common desires – to maintain a reasonable quality of life in retirement, sleep well at night, and not outlive our savings.

Most retirement paychecks are funded by a combination of investment income and withdrawals of principal. Retirement income generators such as annuities or systematic withdrawals often provide more upfront income than a dividend strategy.

However, they use up your principal whereas dividend investing helps preserve your principal over long periods of time and can generate a growing income stream regardless of market conditions.

It goes on to state that you invest $400,000 into Treasury bonds and $600,000 into stocks that yield 3%, good for $18,000 in dividend income each year. After spending every dollar of dividends, you sell part of your bond portfolio to hit your $40,000 inflation-adjusted annual income target. After about 21 years, your bond portfolio would be fully depleted.

However, over that time period, your annual dividend income might have grown by a third to reach $24,000 per year, even after accounting for inflation. Most importantly, you would still own all your stocks.

If your dividend income grew by about 33% after adjusting for inflation, then it is reasonable to believe that the value of your stocks could have appreciated by a similar amount as their growing cash flow made them worth more over time, perhaps reaching close to $800,000 in value.

Assuming you retired no sooner than the age of 60, you would now be in your 80s and have a healthy amount of funds left for the rest of your retirement.

As The Wall Street Journal’s example showed, building a growing stream of dividends can help offset today’s low bond yields while avoiding problems caused by potentially inflated stocks prices – high quality dividend stocks can continue raising their dividend during bear markets.

While some retirees on a systematic withdrawal plan would feel pressure to cut back during stock market declines, you can enjoy a pay raise with the right dividend stocks.

Let’s take a closer look at the benefits and risks of leaning on dividend income in retirement.

Living Off Dividends: The Benefits of Dividend-Paying Companies

While a portfolio of dividend growth stocks will experience some variability in market value, the income that a good portfolio churns out should consistently grow over time. Even during the financial crisis, over 230 companies increased their dividend.

Living on dividend income in retirement provides cash without incurring the stress of figuring out which assets to sell and when, especially if another market crash is around the corner.

Once again, the focus can remain on locating safe dividend payments rather than getting concerned with the market’s price volatility and how that might impact your withdrawal amounts. As long as there is no reduction to the dividend, income keeps rolling in regardless of how the market is behaving.

A great example is our Conservative Retirees model dividend portfolio in our monthly newsletter. While the S&P 500 Index plunged more than 50% during the financial crisis, the stocks we hold would have delivered steady dividend income during this period.

Another benefit of owning dividend stocks in retirement is that many companies increase their dividends over time, helping offset the effects of inflation.

According to the Wall Street Journal, over the past 50 years the S&P 500’s dividends grew at an average 5.7% per year, outpacing the average 4.1% inflation rate. While past performance is not necessarily indicative of future results, retirees who depend on a meaningful amount of dividend income are likely to be in a good position to protect their purchasing power with the right dividend stocks.

Additionally, a dividend investing strategy preserves and grows your principal over long periods of time, unlike most annuities and withdrawal strategies. This allows you to leave a legacy for your family or favorite charities. Dividend investing also provides flexibility to sell off assets if you need to fund special retirement activities or offset some unexpected dividend cuts. Once again, annuities typically lack this flexibility.

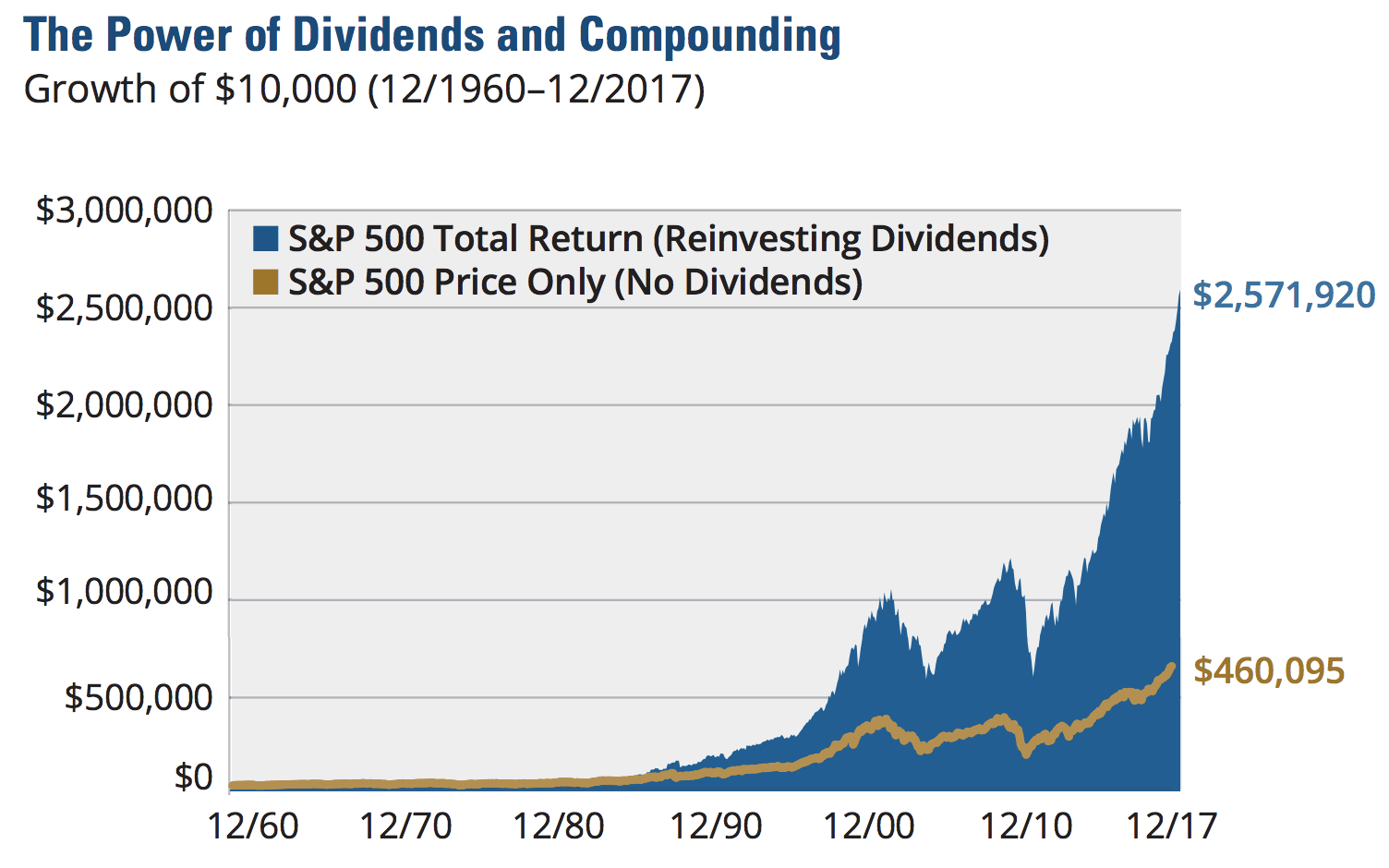

But what does that really mean? Well, suppose you made two $10,000 investments into the S&P 500 back in 1960. One investment received no dividends. Its value was completely driven by the rise (or fall) of the market.

The other $10,000 investment received dividends paid by the S&P 500 companies, reinvesting the payments back into the S&P 500 as they were received.

The latter investment grew to more than $2.5 million by the end of 2017 compared to less than $500,000 for the other investment. Dividends matter.

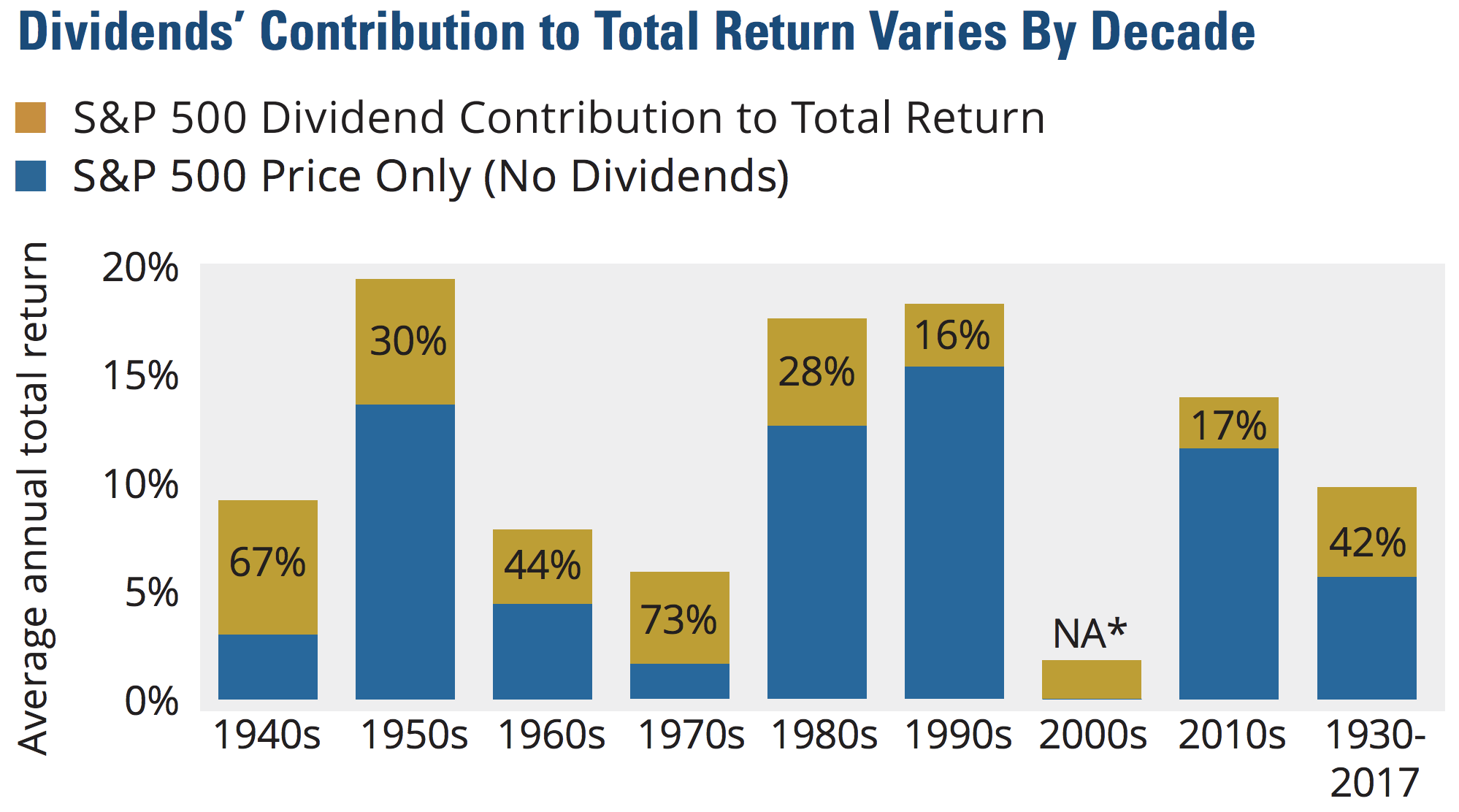

As you might have noticed in the bar chart above, the relative importance of dividends varied from one decade to the next depending on the strength of the market’s price performance. During periods when stock prices stagnate, such as the 1970s and 2000s, dividends make up a greater portion of the market’s return than capital appreciation.

With the market trading at a historically elevated earnings multiple today, making significant capital gains harder to come by, dividends seem likely to account for a meaningful proportion of the market’s total return over the next decade.

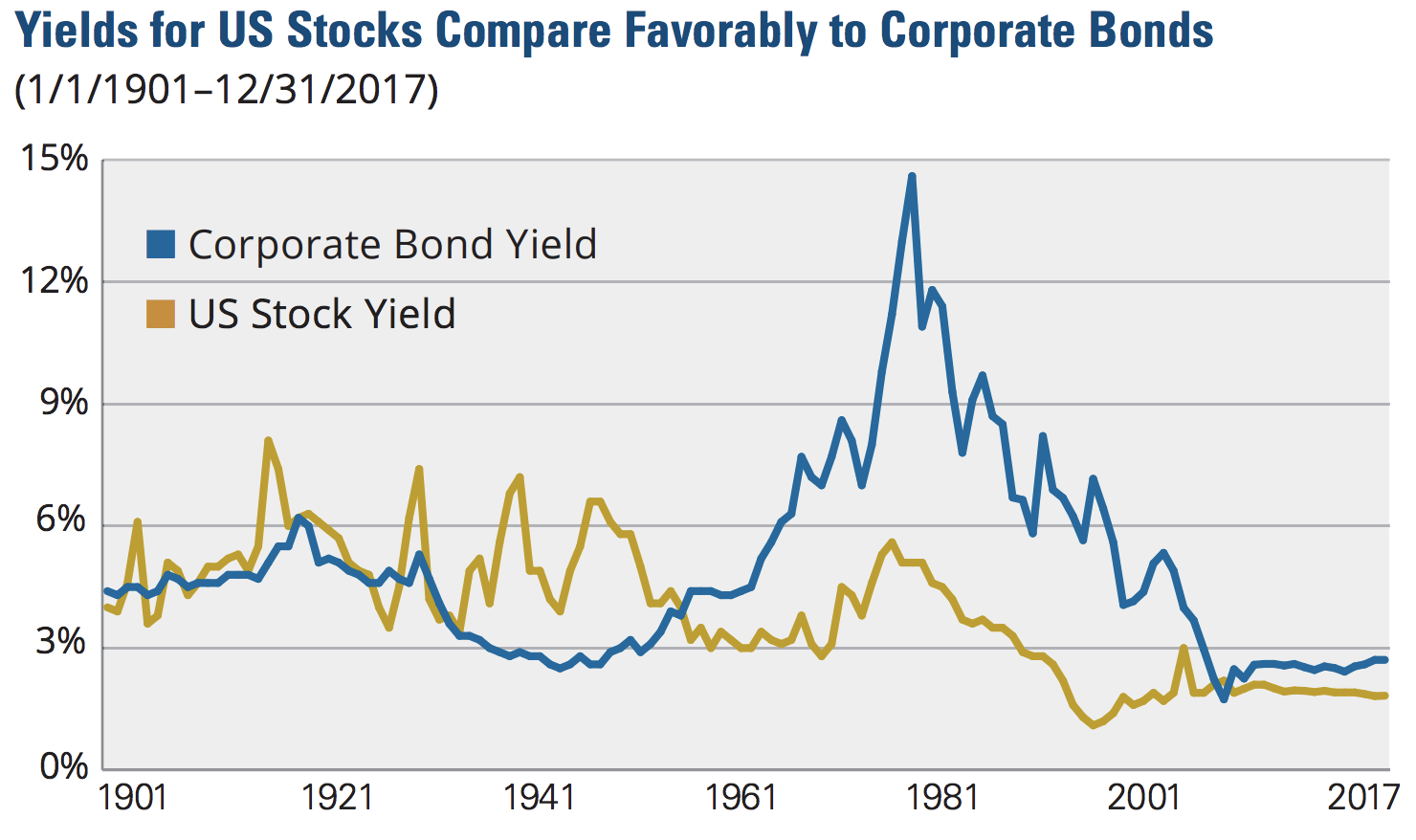

Either way you look at it, stocks are much more attractive than bonds in today’s market environment. The financial world has changed a lot over the last 40 years. As you can see, long gone are the days of double-digit bond yields. Many quality stocks now yield significantly more than corporate bonds.

As Warren Buffett stated in May 2018, “Long-term bonds are a terrible investment at current rates and anything close to current rates.”

Why the hate for long-term bonds? Like many things, it’s simple math for Buffett. Long-term bond yields are 3% today, and their interest income is taxable at the Federal level. In other words, their after-tax yield is about 2.5%.

Meanwhile, the Federal Reserve is targeting 2% annual inflation. So the long-term bonds’ after tax return, adjusted for inflation, is approximately 0.5% per year.

As Buffett put it, long-term bonds at these rates are “ridiculous.” It’s hard to disagree when you consider that long-term stock returns are close to 10% per year, and, unlike bonds (which make fixed interest payments), dividend stocks grow their payouts.

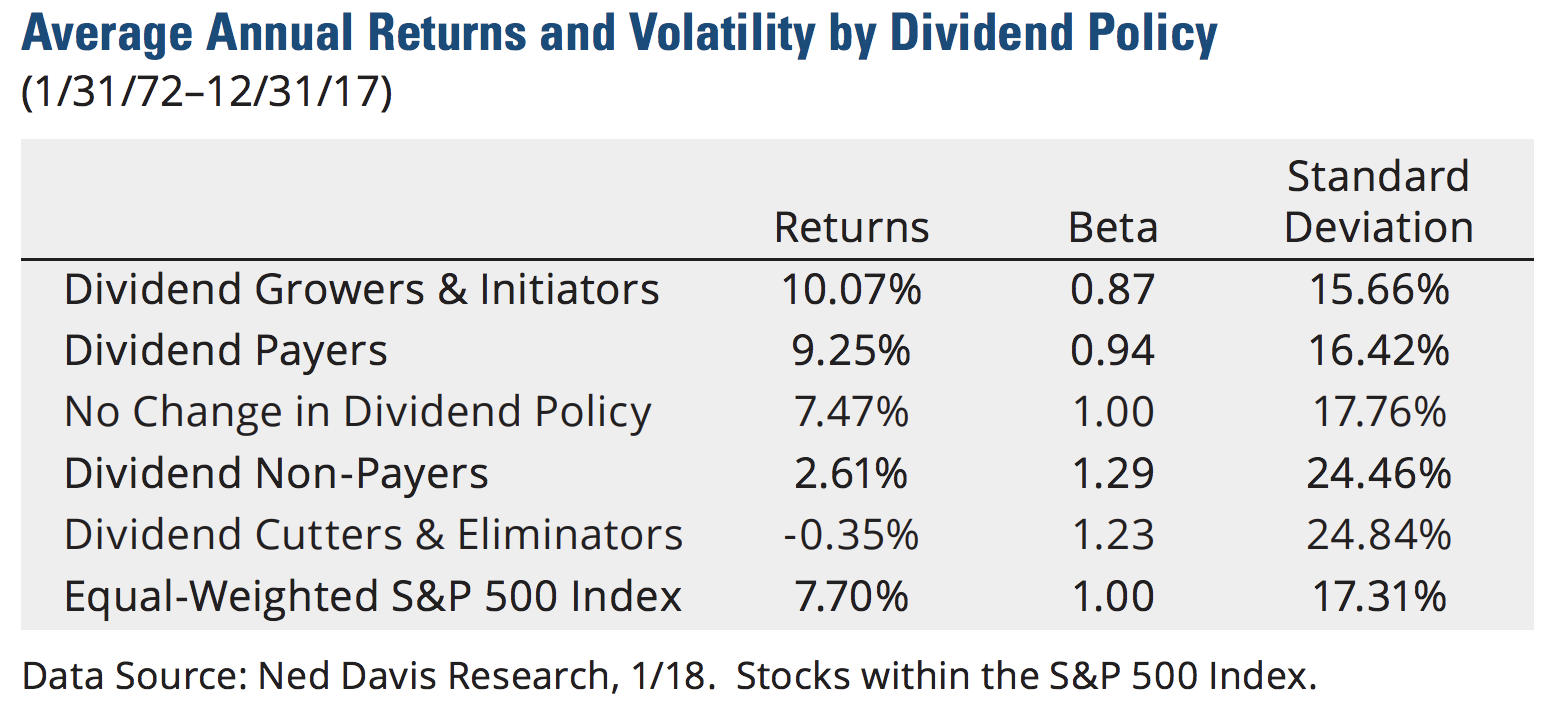

As seen below, dividend-paying stocks in the S&P 500 Index have recorded significantly less volatility (i.e. a lower standard deviation) than non-dividend paying stocks over the last 45 years.

In order to continuously pay a dividend, a company must generate profits above and beyond the operating needs of the business and tends to be more careful with their use of cash.

These qualities filter out many lower quality businesses that have too much debt, volatile earnings, and weak cash flow generation – characteristics that can lead to large capital losses and sizable swings in share prices.

The lower price volatility profile of dividend-paying stocks is attractive for retirees concerned with capital preservation.

Investing in individual securities yourself eliminates the costly fees assessed each year by many ETFs and mutual funds, saving thousands of dollars along the way. All you pay is a one-time commission cost (typically $10 or less per trade with discount brokers) to execute your initial trade to buy the stock.

Higher fees mean less dividend income for retirement. The relatively high fees charged by most fund managers are also a key reason why Warren Buffett advised the typical person to put their money in low-cost index funds for the best long-term results in his 2014 shareholder letter:

“My advice to the trustee couldn’t be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors — whether pension funds, institutions or individuals — who employ high-fee managers…

Both individuals and institutions will constantly be urged to be active by those who profit from giving advice or effecting transactions. The resulting frictional costs can be huge and, for investors in aggregate, devoid of benefit. So ignore the chatter, keep your costs minimal, and invest in stocks as you would in a farm.”

Suppose the $1 million was invested in a dividend-focused fund yielding 3.5%. Over 28% of the $35,000 of dividend income generated would go towards fees.

But what about some of the low-cost dividend ETFs with fees as low as 0.1%? In many cases, investors who are less willing to commit the time or lacking the stomach to buy and hold dividend stocks directly would be wise to evaluate such funds for their portfolios.

However, they lose a valuable benefit: control.

Specifically, almost all ETFs own dozens, hundreds, or even thousands of stocks. Vanguard’s High Dividend Yield ETF (VYM) owns over 350 companies, for example.

Some of these are good businesses with safe dividends, while others are lower in quality and will put their dividends on the chopping block. Some have high yields, others hardly generate much income at all.

Simply put, an ETF is a hodgepodge of companies which may or not match your own income needs and risk tolerance very well.

Vanguard’s High Dividend Yield ETF got into trouble during the financial crisis because it was not focused on dividend safety. The ETF’s dividend income dropped by 25% during this period and took four years to recover to a new high.

Hand-picking your own dividend stocks with a focus on income safety can deliver higher, more predictable, and faster-growing income compared to most low-cost ETFs. You will also better understand all of the investments you own, helping you weather the next downturn with greater confidence.

However, there are several risks to be aware of when it comes to living on dividend income in retirement.

Risks of Living on Dividend Income

However, asset allocation depends on an individual’s unique financial situation and risk tolerance.

A primary investment objective in retirement is to guarantee a minimum daily standard of living so you don’t outlive your nest egg and can sleep well at night.

Some folks are able to meet that minimum income amount they need through some combination of pension income, Social Security payments, and guaranteed interest from certificates of deposit.

In those cases, these investors might allocate upwards of 80-100% of their portfolio to dividend-paying stocks to generate more income and achieve stronger long-term capital appreciation potential and income growth. Your asset mix between bonds, stocks, and cash will ultimately be driven by the income you need to generate and your risk tolerance.

While this goes against traditional asset allocation advice in retirement, which calls for holding a more balanced mix of stocks and bonds (plus 2-3 years of living expenses in cash), these retired folks view their guaranteed Social Security and pension payments as their “bond” income. Therefore, they are comfortable investing more heavily in stocks.

Going more into stocks (even higher quality dividend stocks) will increase your portfolio’s volatility compared to owning a mix of Treasuries and stocks. The upsides are that you will generate more income, that income will grow faster (Treasury payments are fixed), and your portfolio will have much greater long-term potential for capital appreciation.

However, your short-term returns will be less predictable, which can be troublesome if you need to periodically sell portions of your portfolio to make ends meet in retirement or don’t have a stomach for much volatility. A return of 0% from bonds becomes a lot more attractive if your stock portfolio drops by 25%.

Another way you could run into trouble with a dividend strategy is by only owning high-yielding stocks concentrated in one or two sectors, like real estate investment trusts (REITs) and utilities. Should interest rates rise and trigger a major investor exodus in high-yield, low-volatility sectors, significant price volatility and underperformance could occur.

Dividend investors can also fall into the trap of hindsight bias if they are not careful. The desire to own consistent dividend growers has caused groups of stocks like the S&P 500 Dividend Aristocrats Index to become wildly popular with investors. Dividend aristocrats are stocks in the S&P 500 that have increased their dividend for at least the last 25 consecutive years.

These stocks get the attention of dividend investors because they have outperformed the market and we like to assume that many of them will always keep paying and growing their dividends, which is far from guaranteed. Look at General Electric or AIG prior to the financial crisis as examples.

Clearly, it is important to diversify your holdings and remember that you own shares of stock, not bonds. If a company fails to pay back its debt, it files for bankruptcy. If business conditions get tough, it will simply cut the dividend first to stay alive. Generally speaking, stocks and their dividend income are riskier than bonds. There is no free lunch.

However, many of us would prefer to leave our principal untouched and live off the dividend income it generates each month, even if it results in a somewhat lower total return. While this mentality is irrational, it can also create a desire to chase high-yield dividend stocks. In many cases, it is a big mistake to simply reach for dividend stocks that match your yield objective.

Unfortunately, many stocks (excluding some REITs and MLPs) with dividend yields greater than 5% are signaling that something could be structurally wrong with their businesses or that the dividend will need to be cut to help the company survive. In these situations, your principal often faces the greatest risk of long-term erosion.

You must always understand what is enabling the company to offer such a large payout. In our opinion, investors are usually better off pursuing lower risk stocks that yield 5% or less. These companies tend to have better prospects of maintaining and growing earnings and investors’ principal over time.

Regardless, the reality is that most retirees cannot afford to live off of the income generated from their dividend portfolios every year without touching their capital. These investors should especially focus on designing a portfolio for total return rather than for dividend income alone.

Once the portfolio’s objectives and stock and bond allocation are determined, you can figure out how to get the cash flow out of it, whether it’s through asset sales, interest payments, dividends, or something else. Dividend payments are one important way to generate consistent cash flow, but they shouldn’t be looked at in a vacuum. Keep your mind open and be aware of alternative income sources that might be an equally attractive fit for you.

Additional downsides to dividend investing are the time it requires to stay current with your holdings and the learning required to get started. While investing isn’t rocket science, it does require a stomach for risk (i.e. price volatility), enough financial literacy to understand the basic guts of a company, a commitment to stay current with the quality of your holdings, and common sense.