This Chipmaker Is Creating A Whole New Kind of AI – And They Could Pay You While You Wait Out the Coronavirus

A recent advance that largely flew under Wall Street’s radar says a lot about why artificial intelligence (AI) is set to have a $15.7 trillion impact on the global economy.

Known as “neuromorphic computing,” the cutting-edge method gets closer to simulating the way human brains work.

The system could redefine high-performance computing because it operates at lightning speeds and barely sips energy.

Right now, fast and robust graphics processors are the main power behind AI.

That’s set to change because the new chips work especially well for AI-powered neural networks used in speech and pattern recognition, and computer vision.

In fact, Gartner says neuromorphic chips upon which the platform is based, are set to have a huge impact. They could become the predominant computing for AI by 2025.

Today, I’m going to reveal the chipmaker behind this breakthrough and show you why it is well-positioned to handle the coronavirus panic and should at least be on your watchlist…

Transforming Productivity

Now then, I believe giving computers and mobile devices better and more human-like insights is an unstoppable trend.

And I’m not the only one who thinks so. A recent study by Accenture found that AI could boost productivity by 40% by 2035.

Even better, the study found that in 12 advanced economies with combined GDPs of roughly $61 trillion, AI can double economic growth over the period.

For most investors, AI sounds a bit vague. So, let me take a moment to boil it all down for you.

AI basically falls into two main categories – narrow and general. In its narrow form, an AI platform learns a specific task. Think of self-driving cars and virtual assistants like Siri from Apple Inc. (AAPL).

As you might imagine, general AI is more robust. It’s a flexible form of intelligence and can be applied to solve any problem.

General AI works by using a mix of machine learning, neural networks, deep learning, and natural language processing.

For today’s chat, I want to focus on neural networks because this aspect of AI will benefit greatly from the next-gen chip breakthrough we’ve been talking about.

Simply stated, they are made up of interconnected layers of computing units (neurons) that feed data into each other. They are designed to simulate the way our brains process information and are applied to tasks too complex for humans to perform.

Just take a look at Agrobot. The privately held firm is using an AI-powered autonomous harvester to pick strawberries. Agrobot employs a 3D camera to help it pick the ripest fruit without damaging it, something humans find very difficult to achieve for hours on end.

Then there’s 12 Sigma Technologies. It’s developing an AI system to aid with diagnosing lung cancer, a deadly form of the disease with a five-year survival rate of just 17%.

Lung cancer is so fatal because doctors can only see larger nodules growing on the lungs. But 12 Sigma is learning to sift through hundreds of images from CAT scans to develop an early warning system.

Now you know why the recent announcement from Intel Corp. (INTC) about its AI breakthrough is so important.

A New AI Standard

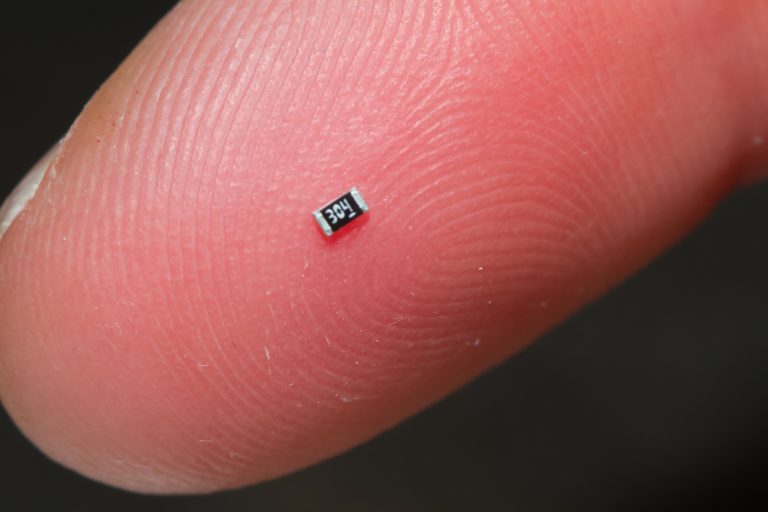

Indeed, Intel has unveiled a computing system with the brainpower of a small animal. It’s built on neuromorphic chips, so-called because the processors are designed to work like an actual brain.

Dubbed Pohoiki Springs, the Intel system is comprised of 768 Loihi neuromorphic chips inside a frame the size of five regular computer servers. These processing chips pack 130,000 artificial neurons and 130 million synapses.

When used in Pohoiki Springs, the number of neurons is boosted to an astounding 100 million (likening it to that of a small mammal).

Gartner predicts that neuromorphic chips will displace graphics processing units (GPUs) by 2025. This is a big deal because GPUs are one of the main computer chips used for AI – especially neural networks.

Unlike traditional computers, which have to process information in one area and then send it along to another area for storage, Loihi is able to perform both functions in the same spot.

Cutting down the distance that data has to travel saves time and energy.

Intel says that the Loihi chips are “1,000 times faster and 10,000 times more efficient at certain tasks than conventional processors”.

And saving energy is a major advantage of neuromorphic computing since energy consumption typically hinders large scale AI deployments.

Recently, Intel researchers were able to train an AI system to recognize hazardous chemical odors often used to mask the presence of drugs or bombs.

It could detect scents like ammonia, acetone, and methane, even when other smells were used to mask them. Loihi only needed a single sample to learn each odor.

Compare that to the 3,000 samples required to train a state-of-the-art deep learning solution to achieve the same level of classification accuracy.

Clearly, Loihi is set to be a game-changer.

Enduring the Bear Market

And the news comes at an overall good time for Intel. Yes, like other chipmakers it will be negatively impacted by the coronavirus economic shutdown.

But I believe it could come out of this period in better shape than many other leading chip firms.

Let’s start with its most recent quarterly report in which the firm beat on both sales and earnings. For the period ended December 31, earnings rose 19% to $1.52. Sales climbed 8% to $20.2 billion.

Next up is the first-quarter earnings statement that comes out on Thursday. That will give us a sense of how the firm is executing against its plan as well as the impact of Covid-19.

Ironically, Intel got little attention from analysts when it released Pohoiki Springs in mid-March. But Wall Street has taken notice of the firm’s vital role in the global chip industry amid the coronavirus shut down.

Bernstein analyst Stacy Rasgon upgraded Intel’s stock from underperform to market perform – ending his bearish call on the company.

Market Watch quoted Rasgon saying “in a rainstorm the guy with the biggest umbrella usually stays the driest”.

The metaphor alludes to Intel’s strong balance sheet and cheaper valuation, which the analyst believes may give the stock a cushion during the Covid-19 market bear market we’re currently experiencing.

Add it all up and you can see why Intel is a powerful company and its stock should be on your bear market tech watchlist.

This is the kind of stock you can count on for the long haul.

And with a dividend yield of 2.4%, Intel is literally paying you to be patient as the tech leader rebounds from the coronavirus panic.