Be Ready Now to Profit from These Bigger, Faster Markets

The legal marijuana market will be far bigger than anyone dares predict, and it’ll get there sooner than anyone thinks.

Last year, total marijuana sales in the U.S. topped $86 billion.

In 2018, all across the country, nearly 49 million people spent an average of $1,755 each on marijuana.

Now, the majority of those sales were illegal, but of that number, about $18 billion was legal.

And it’s this large, established market of marijuana sales that makes the opportunity to profit from cannabis stock investing so rare.

Bringing these sales into the legal light doesn’t require convincing new customers to try something new. No new consumption habits need to be formed. It’s a well-established market just waiting to be sold to.

As the legal market overtakes the illegal market, trillions of dollars in value will be created, and investors that get in now will capture the lion’s share of those profits. It’s a millionaire-minting machine, and the incredible opportunity for normal, everyday investors to participate in these riches is what spurred us to build out community.

We want to put you in the position to reap those gains. And the quicker that legal gap closes, the sooner investors who own cannabis stocks now can pocket the rewards.

Just how big those rewards can be depends a lot on the ultimate size of the legal marijuana market.

And once you see these projections, you’ll know exactly why the opportunity is far bigger than anyone dares to predict…

Mind the Gap

Just how quickly can legal sales fill that gap?

I think that in five years, given the pace of legalization, legal sales could fill most of that gap. After all, Canopy Growth Corporation (NSYE: CGC) would not have agreed to acquire Acreage Holdings (CSE: ACRG, OTC: ACRGF) in the future if it felt that federal legalization was several years away. Similarly, Acreage would not have agreed to sell if it thought that future was very far off. Such a deal would entail too much risk for Canopy and give away too much opportunity for Acreage.

Canopy plunked down $300 million to secure the right to acquire Acreage. That’s far too much money, even for a company like Canopy with billions in cash, to leave sitting around for a year or two.

Closing the gap with illegal sales would put the legal marijuana market at around $100 billion by 2025, once you factor in population growth.

Phase 2 of cannabis investing has the potential to make average Americans millions. You still have time to get in before big business does – but first, you need to click here to watch this landmark announcement that could change your life.

But that $100 billion in revenues only counts current users of traditional marijuana products converting to legal sales. It does nothing to account for totally new users who switch after legalization or the development of new markets.

Nor does it count the creation of new marijuana markets. Once we add those in, the revenue growth that the right cannabis companies enjoy will push their valuations through the stratosphere.

Entirely New Markets

For starters, we need to account for medical marijuana. This market will expand rapidly as knowledge about its superiority over Big Pharma drugs – especially opioids – spreads.

To that, we can add the proliferation of new methods of consumption such as vape pens, gummies, and THC-infused beverages. These products will rope in an entirely new set of recreational users. So between growing medical use and new recreational consumers, that could easily add another $30 billion in sales.

But so far we’re just counting final retail sales only. To all this, you have to add the revenues of the entire cannabis ecosystem. For example, cultivators sell cannabis to product manufacturers. Manufacturers pay extractors. Distributors move the product and sell to retailers. Yet others, like KushCo Holdings Inc. (OTC: KSHB), sell packaging.

Between the growth of new markets and the ecosystem that rises up around it, revenues could easily exceed $250 billion in the U.S. alone.

And we better not forget the big one – cannabinoid-based pharmaceutical drugs.

Big Pharma Gets In on the Act

Frankly, I find accurately estimating the maximum size of the cannabis pharmaceuticals segment an impossible task. The potential for breakthrough discovery treatments is too significant, but let’s add another $100 billion in sales in the U.S. as a ballpark, conservative estimate.

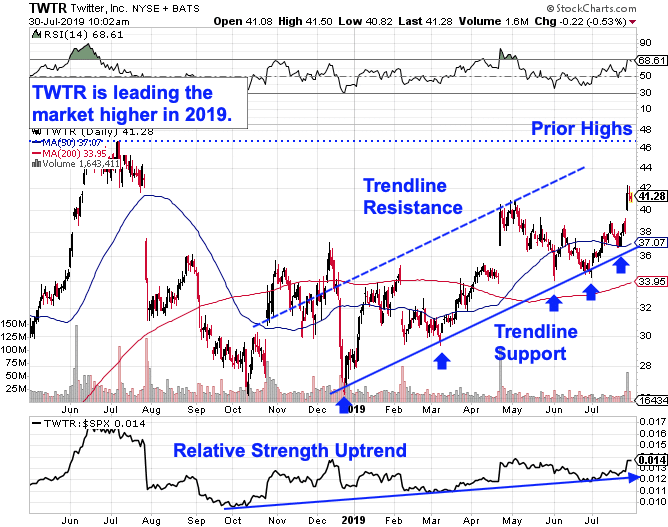

By that count, in five years, total sales across the legal marijuana ecosystem could exceed $350 billion per year. And from a base of $20 billion, revenues have to grow nearly 80% per year to get there. It’s stocks in companies with that incredible level of growth for which institutional investors will pay a very high price. Big money wants in, and once federal regulations are lifted, institutional money is going to rush in.

Revenues growing at 80% annually on its way to $350 billion per year could easily launch the value of cannabis stocks well north of $3 trillion.

And when the bidding starts, you’ll be there to sell your market-leading cannabis stocks to them for a fortune.