The Ultimate Guide on Trading Penny Stocks – TimothySykes.com

Want to learn more about the wonderful world of penny stocks? Start studying the most in-depth and current penny stocks guide in the world!

Trading penny stocks has allowed me to travel to more than 100 countries, meet thousands of interesting people, talk about my skills on television, help build schools in underprivileged countries, and buy what I want, when I want it.

Trading penny stocks also gives me the freedom to work when I feel like it. If I’d rather jet off to the Bahamas, I’ll do that instead.

I’ve made millions trading penny stocks. Do you aspire to do the same?

Let’s be real. Most people probably found this post by Googling something like “how to get rich quick trading penny stocks.” Sorry to disappoint, but I’m not offering any big reveal here.

The secret is there’s no secret. It’s all about hard work, studying, and slow but steady progress. Most of the money I’ve earned has been in small increments … singles, not home runs.

I’m not even right all of the time––as you can see from my trades, which are ALL posted publicly––I’m right about 70% of the time.

But it doesn’t matter that I’m not right all the time. I take the time to look for the right setups, and I’m disciplined about cutting losses. And that puts me far ahead of most of the penny stock traders who eventually fail because they don’t follow the rules.

Are you still with me? Good. Hopefully the get-rich-quick schemers who are too lazy to actually work for success have already clicked off to go blow up their accounts. But if you’ve made it this far, let’s get down to business.

In this post, I want to tell you everything you need to know about how to trade penny stocks, including what they are, how to get started, and how this style of stock trading is different from any other.

Two decades after I first started trading Penny Stocks , I’m more passionate about teaching than trading. Don’t get me wrong — I still trade nearly every day. But I do it just as much to demonstrate my trades for others as to pad my own bank account.

That’s why I’m publishing this guide on Trading Penny Stocks for free online.

I want you to know the basics of pennystocking so you start pursuing your own dreams.

Table of Contents

What Are Penny Stocks and What Is Pennystocking?

A penny stock is a low-priced stock. In spite of the name, it actually refers to stocks trading for under $5 per share.

To put it most simply, pennystocking is the act of trading penny stocks. However, to say that pennystocking is just a matter of buying and selling just like any other stock on a big exchange wouldn’t be quite right. Trading penny stocks comes with its own unique style.

How Do Penny Stocks Work?

Rather than the traditional model of buying and selling stocks based on believing in a company’s long-term prospects, pennystocking relies heavily on chart patterns. You decide what stocks to buy, sell, or short based on patterns or “price moments” in the market.

These aren’t long-term holdings like with blue chip stocks. Rather, you’re trying to take advantage of the short-term movements of a volatile marketplace.

Is It Illegal to Buy Penny Stocks?

No! Penny stocks are perfectly legal. However, there can be shady dealings surrounding penny stocks. While some penny stocks trade on big exchanges like the NYSE, most penny stocks trade via OTC (over the counter) transactions.

The regulations for OTC stocks aren’t as stringent as with the bigger exchanges, so there’s a higher possibility of fraudulent behavior.

Yes … there’s some bad stuff that goes on, but the good news is that with practice and a little research it’s pretty easy to see through these schemes … and to even use them to your advantage!

How to Invest in Penny Stocks

There are several ways to invest in penny stocks. The most common strategy is to buy them based on your supposition that the stock price will rise, then sell those shares once they reach a desirable price.

That’s a huge oversimplification, but I’ll get into more detail later in this guide.

You can also short-sell Penny Stocks, which means that you believe a penny stock’s price will decline. You essentially borrow shares that you don’t already own, then sell them when the price drops.

Regardless of how you invest in Penny Stocks, though, the goal is always to generate a profit. The profits might be small, but they add up over time.

Who Is This Penny Stock Guide For?

Well, you already know who this guide isn’t for: people who want to get rich quick. There are no guarantees in the stock market, and for every one person who does strike gold, there are hundreds –– thousands! –– who blow up their accounts.

This guide is for anyone who truly wants to understand trading penny stocks and who wants to work toward their goals the right way … over time and with discipline.

Where’s the fun in that? Well, I’ll be honest … stock trading isn’t always fun. Yes, there’s the exhilaration of a buy or sell order, but most of it is just hard work and research and maintaining a strong watchlist and looking for patterns.

For me, trading penny stocks was about getting rich at first .. but not anymore. More importantly, for me, trading is the gateway to freedom.

Because I traded penny stocks, I made enough money so that I can travel the world and do what I want to do when I want to. That’s the kind of life I want.

I operate multiple charities and just opened my 57th school. Those might not be your goals, but the point is that penny stocks could help you work toward whatever your goals are.

These days, I only trade part time and focus primarily on teaching. Why? Because I want to be the mentor I never had when I was starting out.

There’s a lot of BS in the trading world, and I want to cut through it so you can find the same freedom I did!

By the time you finish reading this guide, you can have more knowledge and strategies for your first forays into the stock market. If you’re not willing to learn and study, you probably won’t find much success. That’s the bottom line.

What are the Most Common Investment Types?

I’m not an investment advisor — I’m a trading educator who specializes in penny stocks. But I think everyone should know investment basics. Like trading, investing involves risk. Bottom line: Never risk more than you can afford.

Penny stocks are a type of investment … but what is an investment, exactly? Investments are all over the place: things that you can put your money into with the hope of a return.

To invest your money wisely, you need to choose a legit enterprise. Ideally, you want to choose one that minimizes risk while maximizing returns.

Penny stocks are just one type of stock. A stock is a contract that gives you partial ownership of a company. Companies raise money through the stock market to expand, hire more employees, create new prototypes, and fund other expenses.

As an investor, you’re buying shares of that company, which can drive up the price. If you make the right call, you sell when the price goes up (or down, if you’re short selling) and take your profits.

But stocks are just one type of investment. There are plenty of others. Here are some common types.

Stocks Vs. Commodities vs. Derivatives vs. Real Estate

There are four basic categories of investments: stocks, commodities, derivatives, and real estate.

- Stocks are shares of a company. You can buy shares at a particular price, and sell them for either a profit or loss.

- Commodities refer to physical substances or raw materials that come from the earth. Think: gold, silver, oil, wheat. They’re traded on an open exchange, with the most common commodity being oil.

- Derivatives are investments that take their value from something else. Options are an example of a derivative: instead of buying or selling a stock directly, you create a contract with the option to buy or sell a certain number of shares at a specific date.

- Real estate is a whole different beast. There are various styles of investing in real estate, including flipping houses sold at auction, renting properties to tenants, developing commercial spaces, and so on. It’s not my scene, but you do you.

Unique Penny Stock Characteristics

Penny stocks aren’t like other stocks.

For one thing, these are not stable, established companies. They’re generally small. They might be new, they might be in an up and coming sector. They might even be in danger of going out of business.

This part is important: unless they are listed on a bigger exchange, they’re not required to make the same SEC filings that are required of bigger companies. This means that things you might take for granted with bigger companies can’t be taken for granted with penny stocks.

However, it also means that you’re rewarded for doing your own research.

A lot of people are understandably wary about penny stocks because they can be kind of sketchy. However, usually this is because they think it’s too risky, too hard, and don’t want to spend the time figuring things out themselves.

But if you’re willing to spend the time to do a little research and look at the charts, you might agree with me that they’re actually pretty simple to trade. I personally think that you can learn to trade penny stocks a lot faster than you can learn about trading larger securities.

Additionally, penny stocks are unique in that you can learn as you go. Since you’re only investing small amounts in each play, your returns may be small…but so are your losses. This allows you to scale up slowly, over time.

That is to say: penny stocks can be risky, but you yourself don’t have to take huge risks. By taking small positions, you can avoid the big risks that lead to big losses.

Are Penny Stocks Worth it in 2020?

I’ll be the first to admit: I’m biased. Penny stocks have made me millions. So are they worth it? Can they help you grow your account? Naturally, I think they are. But these are possibilities, not promises. There are a lot of factors at play.

Penny stocks are NOT for every trader.

You need to have a good work ethic.

You need to learn to think for yourself.

You need to be willing to do research.

You need to be disciplined to trade penny stocks.

You need to learn … a lot.

You need to be able to stick with your trading plan.

If you can’t do ALL of these things, then penny stocks are not worth it for you. But if you’re willing to educate yourself and become a self sufficient trader, then my vote is yes: I think penny stocks are worth it.

The Risks of Investing in Penny Stocks

Are there risks associated with penny stocks? Yes. Yes, there are.

Among them?

- They’re generally not as regulated as large cap stocks.

- They’re volatile.

- Most of the companies will fail.

But here’s the thing. There are risks associated with ANY type of investment.

Take, for example, IPOs. As I wrote in this post, a ton of recent IPOs have tanked, leaving investors holding stocks that are seriously underwater.

There’s also the consideration of time. Is it really worth waiting years and years for returns?

Investing in large cap companies can pay off…but it can take years, and even then there are no guarantees.

With penny stocks, if you’re willing to study and do the work necessary to mitigate the risk, it could pay off.

How to Develop the Right Mindset for Trading Penny Stocks

You know what? I don’t like risk. Liking risk isn’t necessary to trade penny stocks. In fact, I urge you to hate risk! That will make you willing to do whatever it takes to avoid it.

It’s simple logic: If you take huge risks in the stock market, you stand to lose a huge amount of money. In some cases, you could lose even more than you invested in the first place.

That’s not my idea of a sound trading strategy.

If you want to stay in the game for the long run, focus on watching stock performance and hedging your bets. Never invest more than 10 percent of your trading account on a single play, and if you have a small trading account, limit that to 1 percent.

You also need to set your own boundaries based on your risk tolerance. What are you willing to bet on a single play, and what will happen if you’re wrong? Write down your own rules and stick to them.

It’s also necessary to change your mindset about failure. In the stock market and in business, failure isn’t just acceptable — it’s unavoidable. You can’t invest in penny stocks without failing at some point. I’ve failed over and over again.

Don’t believe it? Check out my book, “An American Hedge Fund,” where I recount some of my biggest mistakes in full detail.

Instead of trying to avoid failure, resolve to learn from it. If you’re willing to work hard, accept failure, and learn from your mistakes, pennystocking could be right up your alley. You’ll learn that failures eventually turn into success!

How to Trade Penny Stocks

The first thing that you’ll need trade penny stocks? An education.

Before you can hope to have any success as a trader, you need to learn what penny stocks are, how they work, and how to identify patterns.

You can get started with this free Pennystocking 101 guide. From there, if you want to take it to the next level, consider joining my Trading Challenge.

Once you’re ready to actually get started trading, you’ll need a few key things:

- Broker: To trade stocks, you need to open a brokerage account. Your broker is the gateway between you and trades. It’s vital to choose a good one … don’t just go with the cheapest one. Don’t make this decision lightly! Check out this guide for more advice.

- Stock screener: You’ll need to narrow down the many choices of stocks to trade somehow. A stock screener can help you do this. You can use it to filter based on criteria that you set, for instance percentage gainers with volume, etc. I use StocksToTrade, which can also help you with the next item on the list…

- Charting software: To really get a good overview of a stock’s health, you’ll need to perform detailed stock analysis.

There are two key types of stock analysis: fundamental analysis, where you look at the company itself, and technical analysis, where you look at the stock’s chart and try to find recognizable patterns.

StocksToTrade can help you do both: it’s got awesome charting software, but also links to relevant news, SEC filings, and even social media mentions related to stocks.

Both types of analysis are important, but with penny stocks, technical analysis is more important. I read chart patterns constantly because I want to see how a stock has performed over weeks, months, or even years. What patterns can I detect in those charts? What might influence forecasted performance? - Trading plan: A trading plan is vital to trading penny stocks. This is like a map where you plot out your entry and exit points. Ideally, you’ve based these numbers on careful research, and have the discipline to actually stick to your plan.

Important Stock Terms You Need To Know

Whether you’re trading penny stocks or higher-priced stocks, you’ll need to be familiar with some basic trading terms. Let’s go through them quickly:

- Buy: To buy shares of stock with the purpose of profiting off an increase in stock price

- Sell: To sell shares of stock to make a profit or prevent further losses

- Short sell: Borrowing stock you don’t own for the purpose of profiting off a stock that dips in price

- Buy to cover: Buying back the shares of stock you sold short to profit

- Bid: The greatest price someone else is willing to pay for a stock

- Ask: The asking price for a share of stock

- Spread: The difference between the bid and ask prices

- Uptick: A situation where a subsequent trade is at a higher price than the previous one

- Downtick: The opposite of an uptick

Want more? Check out these 37 Stock Market Terms Every Trader Should Know.

What Are the Key Indicators of Good Penny Stocks?

When evaluating potential penny stocks, you want to look at key indicators to determine whether a stock will perform well in the future.

Penny stocks don’t always have much in the way of fundamental information, since they aren’t necessarily required to file the same paperwork that’s required of large cap stocks on bigger exchanges.

All the same, you should look around for both positive and negative indicators … these can further inform you of how much risk you’re taking on by investing in a particular stock.

Positive Indicators

Positive indicators can help you see whether or not a stock could be poised to rise in value. Here are some to look for:

- Positive earnings or new contracts

- Positive financing

- New partnerships

- Increases in trading volume

- Positive industry news

Negative Indicators

Yeah, negative indicators are important too, because they can tell you when the stock could go down in value … they might help you decide to stay away, or they could let you know if a stock is a contender for short selling. Here are some to look for:

- Financing secured through desperation

- Rumors of negativity from within the company

- Negative industry news

- Reduced trading volume

Where to Buy Penny Stocks

While some penny stocks can be found on major exchanges, you’ll mostly be trading on OTC exchanges. What are they?

Certain stocks don’t meet the requirements of the bigger exchanges for various reasons, such as size, profits, etc. Maybe they’re just starting out, or maybe they’re in new or emerging sectors.

For companies like these, there are OTC (“over the counter”) markets. These stocks tend to be lower in price but higher in risk, since they are generally up and coming companies, and their listing requirements aren’t as stringent as NYSE or NASDAQ.

For a full list of the exchanges I use to buy penny stocks, check out this guide.

How to Find Top Penny Stocks to Invest In

Wanna find great stocks to trade? Here are some of the necessary steps you’ll need to take.

Using Scanners to Find Penny Stocks

There are thousands of stocks to choose from. How can you narrow down the choices? With a stock screener. A stock screener lets you filter based on criteria that you set so that you can find the best contenders for trades that fit setups that work for you.

I helped create what I consider one of the best screeners out there: StocksToTrade. Created by traders for traders, this is a one-stop-shop of a screener that has amazing charting software and research tools, too.

Oh, and for traders who are still getting up to speed –– it’s got a great paper trading (virtual trading) module, too.

How to Develop Your Own Trading Strategy for Penny Stocks

All of the information I’ve presented so far is all well and good … but if you really want to become a successful penny stock trader, you need to develop your own trading strategy.

Why not just follow what other traders are doing, or trade based on my alerts? Because it’s impossible to replicate what another trader does.

Every trader has their own unique style…and strengths and weaknesses. So rather than trying to follow stock alerts, work on increasing your knowledge and developing your own trading style.

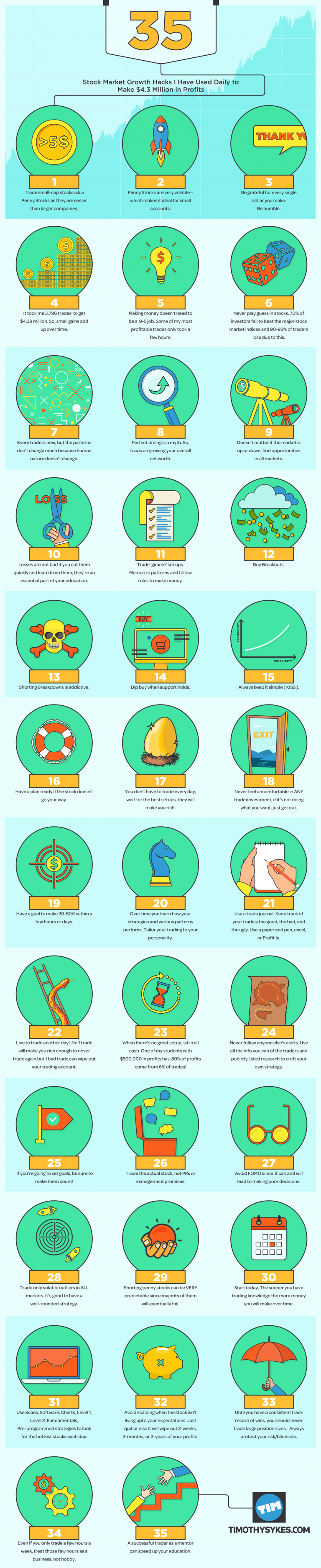

Tim’s Best Tips from Winning Big with Penny Stocks

Want some real insider tips about how to get ahead as a penny stock trader? Here they are.

- Educate yourself. Education is the key to everything … especially in the stock market. The more you learn, the better you’ll be able to navigate what the market sends your way. Which leads to the next tip…

- Be adaptable. Just because patterns repeat themselves doesn’t mean you can become complacent. The stock market is constantly evolving. The same setup that’s worked 99 times in a row might not work tomorrow, even if you don’t change a thing. Unless you want to become extinct as a trader, be nimble and adaptable to the ever-changing market. The best way to be adaptable? Focus on constantly learning.

- Maintain a strong penny stocks watchlist. To stay on top of the best opportunities, you have to create and maintain a strong watchlist. This is a list of stocks that you’re interested in. Monitor them regularly, and weed as needed. When they fall into your desired price range, be ready to pounce.

- Keep records of what you do. A trading diary is one of the most important assets for any investor. In it, you’ll record every trade you make as well as your observations and the results. It will help you avoid making the same mistake twice. Plus, it can become a teaching tool if you ever want to help a friend or relative invest in them.

- Learn from your mistakes. Have you ever lost $500,000 on a single play? I have.

My mistakes are numerous, but I’m still successful. That’s something I want you to keep in mind as you embrace penny stocks. Yes, you’ll lose money, but it’s part of the process. My goal is to help you profit more than you lose!

Apply for the Trading Challenge and Start Investing in Penny Stocks

Do you want to have the freedom to trade wherever you want? Penny stocks could help you find financial freedom, but only if you approach them with the right mindset.

If you want to fast forward your learning curve, consider applying for my Trading Challenge. In the Challenge, I’m playing the role of the mentor I never had when I was learning how to trade. Why make mistakes that you don’t need to?

Learn from my errors, and benefit from the lessons I learned the hard way over the past 20+ years! Plus, improve your trading in the company of an incredible community of highly motivated, like-minded traders.

What Are the Key Indicators of Good Penny Stocks?

I call myself a glorified history teacher, because I’m constantly looking to the past to try and figure out how stocks might move in the future.

In my 20+ years of trading, I’ve been obsessive about seeking out patterns so that I can stay safe and make predictions about how stocks might perform in the future. No, it’s not an exact science, but history usually repeats itself pretty closely.

Yes, you need to learn to read chart patterns…but more importantly, you need to learn to understand them. This is something that really only happens with time and practice, which is why it’s SO important to study.

Over the years, I’ve narrowed it down to a few key patterns that have made me millions.* Perhaps my crowning glory is the Supernova pattern, which is a stock that sparks, explodes, then fades into oblivion. Sounds scary, but it actually presents many opportunities for traders!

To learn about my key penny stock trading patterns, check out this post.

When evaluating potential Penny Stocks, you want to look at key indicators to determine whether a stock will perform well in the future. Penny Stocks don’t have much in the way of fundamental information because, as I said before, they don’t have to publish financial documents.

However, there are a few things to look for when trading Penny Stocks. Positive and negative indicators tell you what kind of risk you’re taking on by investing in a particular stock, even at a nominal amount.

Positive Indicators to look for before trading

The positive indicators you want to look for include the following:

- Positive earnings and new contracts

- Positive financing

- New partnerships

- Increases in trading volume

- Positive industry news

Negative Indicators to look out for with Stocks

You also want to look for negative indicators that suggest you should steer clear of a stock or short-sell it:

- Financing secured through desperation

- Rumors of negativity from within the company

- Poor industry news

- Reduced trading volume

Key Chart Patterns of Penny Stocks

Since they are thin on fundamentals, technicals take on a far more important role. Learning how to read chart patterns can make you a better trader. More importantly, you’ll begin to understand how stocks behave in specific market conditions.

This is something that happens over time. You can learn to read chart patterns but still not really understand them. Think of each stock as a personality. It has its own way of moving depending on the company behind it and external factors.

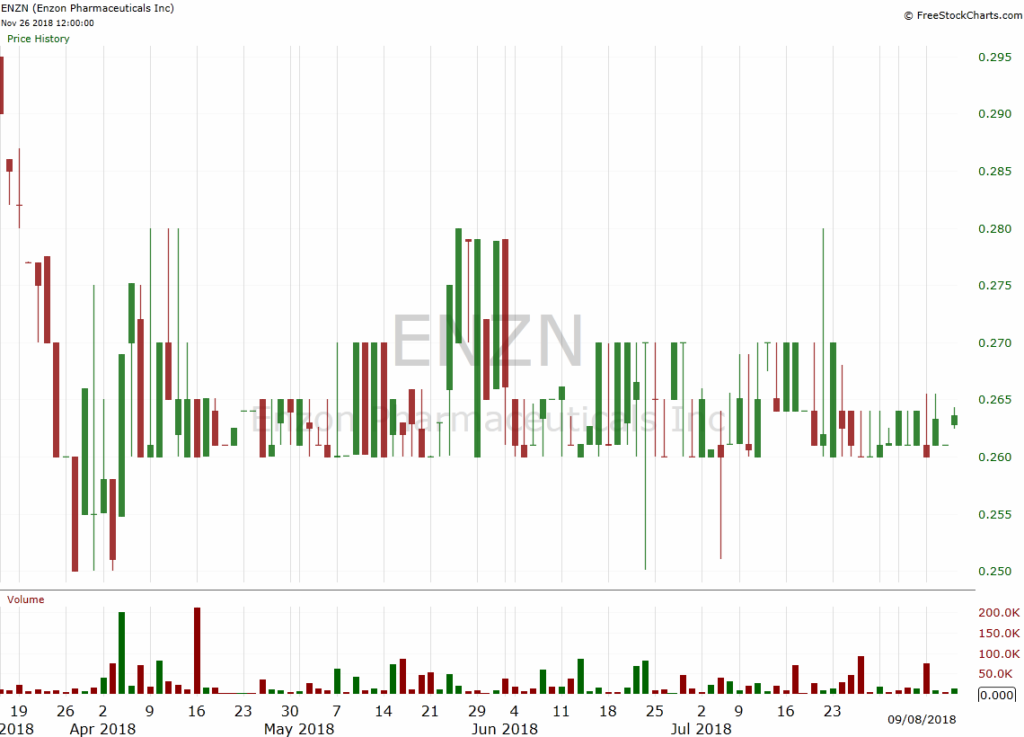

Regardless of the type of chart you prefer, I recommend looking at a six-month snapshot. That’s usually a healthy time period by which to judge a stock’s momentum.

Chart Types

The four most common types of charts are the following:

- Bar

- Line

- Area

- Candlestick

Personally, I favor the candlestick. It’s easy to read movement in a candlestick chart based on whether the “wicks” are black, white, or red. Others like bar and line charts because of their simplicity, while I don’t know anyone who prefers area charts. They’re messy and difficult to understand at a glance.

Stock Chart Patterns

Chart patterns describe how a stock price moves over time — specifically in up and down movements. Although history doesn’t always predict the future, you can identify patterns that allow you to make educated guesses about a stock’s future performance.

Clean Stock Chart

This is my favorite type of chart. The stock’s price moves in one direction — up or down — with regular but brief changes in direction that quickly reverse.

I can’t stress enough that you need to pay attention to clean charts. They’re highly predictive and can allow you to take advantage of quick profits on a long position or a short-sell.

However, you don’t want a chart that looks too clean. This type of chart has an upward or downward trend with almost no variation. An extremely clean chart — especially one that remains clean for six to 12 months — often precipitates a steep increase followed by a steep decrease in price. If you’re not fast enough, you could lose significant cash.

Clean Bullish

You might have heard the terms bull and bear market. A bull market trends upward, while a bear market trends down. The same applies to chart patterns.

A clean bullish chart shows a steady upward trend. The stock price might fall on occasion, but it jumps right back up — often farther than it was before its brief decline. This is a good time to make your play because you’re likely to see the trend continue.

Clean Bearish

A clean bearish chart is the exact opposite of the clean bullish chart. There’s a definitive decline in stock price over time. It might spike every once in a while, but the downhill pattern is evident from first glance.

It often happens after a steep increase in price. A company might announce new funding, for instance, that excites investors. The stock price shoots up, but it can’t sustain the hype, so it begins to fall precipitously.

Clean Breakout and Clean Breakdown

Clean breakouts and clean breakdowns show that a stock has either broken through resistance or fallen below support respectively. The chart is clean because the pattern either repeats itself or shows significant pattern repeats prior to the breakout or breakdown.

Clean Cup and Handle

You can identify a cup and handle chart by its shape. You’ll see a smooth downward trend followed by an equally smooth upward trend. After that, the price drops precipitously. It’s difficult to play this type of chart, but I’ve done it.

Messy Stock

I encourage you to look at messy stocks. Their charts are all over the place with no discernible pattern. The stock price might jump for no reason at all, fall a little bit, rise a little bit, fall again, and so on. But those peaks and valleys don’t repeat reliably.

While I think you can learn from these charts, don’t trade on them. There’s no way to predict what the stock will do next because you don’t have a pattern from which to learn.

Messy Breakdown

A messy break down starts with an upward trend. At first, the chart will look pretty clean (and appealing). Then, seemingly out of the blue, it’ll drop. The pattern becomes extremely messy from there, with dips and increases that have no obvious reason behind them.

Others

Later in this guide, I’ll cover even more chart patterns that you might want to consider watching. I’ll also go into more depth about the patterns listed above so you can begin to visualize what ideal stock charts look like.

The Best Penny Stocks Chart Patterns

Now, we’re getting to the good stuff. Nobody else (except my Trading Challenge students) uses these charts because they’re mine. I created them after watching stock charts for years and better understanding the patterns that play out.

The Supernova Penny Stock Chart Pattern

We’ll start with my favorite. The Supernova looks like a stock chart exploded. It might have experienced modest peaks and valleys over several months, then it skyrockets for a short period of time. If you catch a Supernova, you can easily triple your investment or more. I’ve seen Penny Stocks shoot up to 10 or more times their original price.

The Stair Stepper

As the name suggests, this stock pattern looks just like a staircase when viewed from the side. It goes up, then flatlines, then goes up again. There might be a few dips along the way, but the stair-stepper pattern repeats.

The Snore

Ignore this stock pattern at all costs. It’s incredibly boring because it lacks liquidity and volatility

The Crow

I named this pattern the crow because it’s like watching a bird pick off your investment one chunk at a time until there’s nothing left. If you start to see a crow pattern, get out immediately to avoid potential losses.

I’ve developed my own penny stock chart patterns. Want to see? Of course you do!

Enroll Yourself in the Penny Stocks Trading Challenge

Are you interested in living the laptop lifestyle? Are you saving for a particular expense? Do you want to free yourself from financial constraints?

If you answered “yes” to any of those questions, consider applying for my Penny Stocks Trading Challenge. It’s a fantastic opportunity to learn from some of the best minds in penny stocks and other investment vehicles. We work with people daily to help them achieve their specific dreams.

The link to apply is below:

Apply for my Trading Challenge

Frequently Asked Questions about penny stocks

What Are Penny Stocks?

Penny stocks, also known as one-cent stocks, are common shares of small companies that trade at lower prices per share. Despite the name, a stock is considered a penny stock if it’s valued at $5 or less per share.

Are Penny Stocks Stable?

The companies behind them are often unstable, new to their industries, or have low net worths. Many only sell a few products or services, and most don’t publish their financial records. Because of their volatility, they also represent an amazing opportunity for people like you and me. The fast-moving stocks allow you to take day trading to a whole new level. Instead of buying a stock when

How do you Invest in Penny Stocks?

There are several ways to invest in penny stocks. The most common strategy is to buy them based on your supposition that the stock price will rise, then sell those shares once they reach a desirable price.

What Are the Key Indicators of Good Penny Stocks?

There are a few things to look for when trading Penny Stocks. Positive and negative indicators tell you what kind of risk you’re taking on by investing in a particular stock, even at a nominal amount.

How Much Money Do You Need to Trade Penny Stocks?

Depending on the broker you choose, you might be able to start an account with as little as a few bucks. However, I don’t really suggest starting lower than $500 or so. I personally started with a little over $12,000, but you don’t have to follow my exact lead.

Ultimately, the amount is up to you –– but do choose an amount that you’re comfortable losing. Never trade with money you can’t afford to lose.

Can You Make Money in Penny Stocks?

I can’t say what will happen for you, because I have no idea what your strategy, work ethic, and trading mentality is like. However, I can say that I have made millions by trading penny stocks. Several of my students have made six figures trading penny stocks.

A few are even confirmed millionaires. So is it possible to make money in penny stocks? Yes. Will you definitely make money? No. That’s impossible to predict.

Are Penny Stocks Stable?

Here’s the deal. The companies behind penny stocks are often unstable. This might be because they’re new to the industry, in emerging sectors, or because the companies simply have a low net worth. Many of them depend on just a few products or services, and many don’t publish financial records.

So yeah, they can be volatile. However, it’s this volatility that presents a great opportunity for traders like me … and maybe you! These fast-moving stocks have the ability to experience huge gains in small amounts of time, and that can potentially grow your account fast.

What Are the Best Penny Stock Apps?

The best penny stock apps are going to be the ones that focus on information and education. For my money? Enrolling in an educational program like my Trading Challenge and seeking out a great screener like StocksToTrade are smart investments you can make.

Conclusion – Are You Ready to Start Trading Penny Stocks in 2020?

You’ve made it this far in the guide, and that tells me a lot about your willingness to learn.

Penny stocks are not for everyone. They’re volatile, the companies can be sketchy, and they do present a significant level of risk for you as the investor. However, there are ways to mitigate that risk and make smart trades.

By taking the time to educate yourself and scale up slowly, over time, you’ll be taking the right steps to build a strong foundation and have a much higher likelihood of finding long-term trading success.

[Please note that my results and those of my top students aren’t typical. I’ve put in the time and dedication and have exceptional skills and knowledge. Most traders lose money. Always remember trading is risky … never risk more than you can afford.]

Are you willing to put in the work that’s necessary to be a smart penny stock investor?